Which cuts of meat have increased the most?

The beef cuts that increased the most in April were ossobuco, rump cap, and shoulder (6.5%). But chicken was the most expensive, with a 10.7% increase compared to March.

The data were presented by the Price Observatory of the Argentine Center for Political Economy (CEPA) , using the statistical series of the Argentine Beef Promotion Institute (Ipcva).

Others Beef cuts that registered significant increases last month were: rump (5.7%), homemade hamburgers (5.6%), roast beef (5.4%), rump / rump cap (5.2%), baby turtle (5.2%) and loin ball (4.7%).

Price of meat 3.jpg

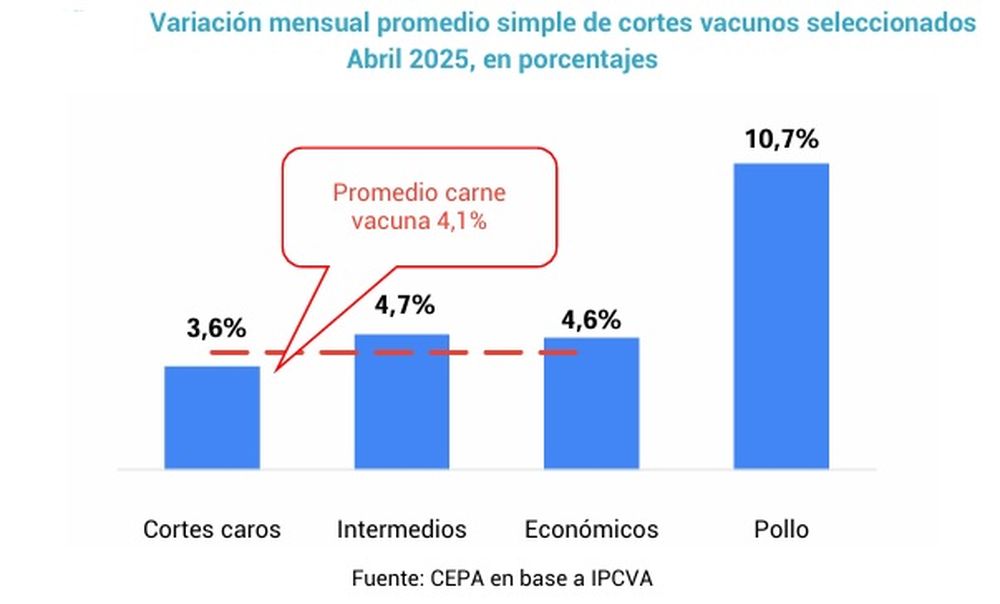

Counter prices for various cuts of beef rose 4.1% in April compared to March (when they had risen 7.5%). Year-over-year, these cuts increased their prices by 60.1%, 12.5 percentage points above the overall price increase in the economy (47.6%).

The CEPA report highlights that, as of March 2025, the year-over-year variation in the average prices of the different cuts remains above the year-over-year inflation rate. Since December 2024, retail prices rose above general inflation: 10.3 percentage points in December 2024, 0.7 in January 2025, 8.0 in February, 3.8 in March, and 1.1 in April, considering an inflation rate of 3.0% for the latter month.

Price of meat 1.jpg

In April, the so-called "intermediate" cuts of meat saw the largest increase among the various categories, with an average rise of 4.7%. They were followed by "economy" cuts, which increased 4.6%, and "expensive" cuts, with an increase of 3.6%. Meanwhile, the price of chicken soared 10.7%, marking the largest monthly increase since March 2024, when it had risen 15.5%.

Price of meat 2.jpg

The study also suggests that there are differences in price trends depending on the sales channel: in April, the average price of beef registered a monthly increase of 4.8% in butcher shops, while in supermarkets the increase was 2.6%. So far this year, prices in butcher shops have accumulated a 28.4% increase, that is, 3.1 percentage points higher than the increase observed in supermarkets (25.3%).

Chicken versus meatThe price of chicken has seen a cumulative increase of 16.6% so far this year. The rise accelerated in April, with a 10.7% increase, after rising 4.3% in March. To assess the price relationship between roast meat and chicken, the reference is usually how many kilos of chicken can be purchased for the price of one kilo of roast meat.

After reaching a peak of 3.49 in December 2023—driven by a sharp increase in beef prices—this gap began to narrow. Chicken gained ground in household consumption, and in September 2024 the ratio reached its lowest, with 2.57 kilos of chicken for every kilo of roast beef.

A very good decade for chicken producers is completed.

Starting in October, the gap widened again, reaching a new high of 3.28 in March 2025. This means that one kilo of roast beef could buy 3.28 kilos of chicken, the highest price in the last year. This trend was due to the relative rise in the price of beef compared to chicken. However, with the sharp increase in chicken prices recorded in April, the ratio fell back to 3.07.

The decline in wages changed household consumption habits: beef was displaced by cheaper alternatives, such as poultry and pork, which gradually gained ground. In 2024, for the first time in history, poultry consumption surpassed beef, reaching 49.3 kilos per capita annually.

For its part, pork consumption has been growing significantly and in 2024 reached its maximum peak of 18 kg/year, exceeding the initial projection made by the Rosario Stock Exchange (16.4 kg).

losandes