Can the MPC open champagne? Core inflation hits the target

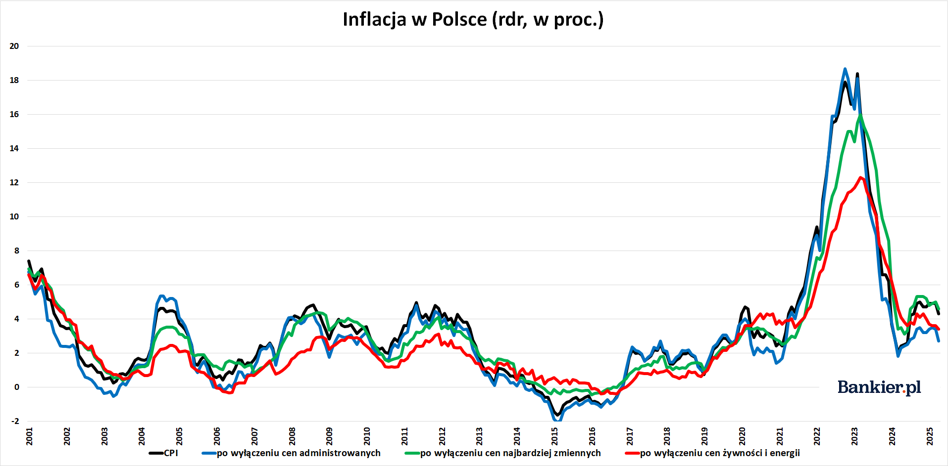

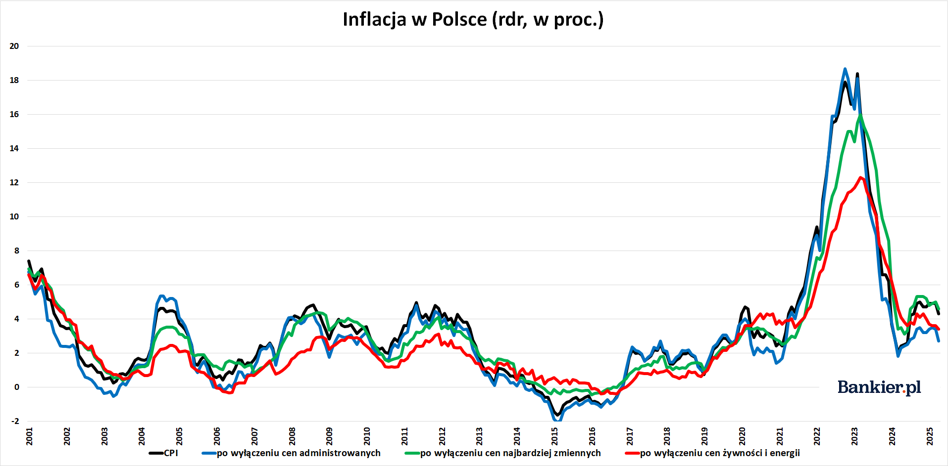

In April, core inflation was above zero for the first time in over 5 years. within the permissible deviation from the NBP target of 2.5 percent, above which has been continuously for almost six years.

According to data published today by the National Bank of Poland in April 2025 year-on-year inflation:

- Excluding food and energy prices , it was 3.4 percent, down from 3.6 percent in March. Economists had expected it to fall only to 3.5 percent.

- after excluding administered prices (subject to state control) it amounted to 2.7 percent, compared to 3.4 percent a month earlier,

- after excluding the most volatile prices it amounted to 4.6 per cent, compared to 5.0 per cent a month earlier;

- The so-called 15% trimmed average, which eliminates the impact of 15% of the basket of prices with the lowest and highest dynamics, amounted to 3.9%, compared to 4.6% a month earlier.

Thus, in April , the CPI core inflation rate was at the lowest level since January 2020 and for the first time since then was within the range of permissible deviations (i.e. +/- 1 percentage point) from 2.5 percent target of the National Bank of Poland.

However, the April core inflation reading still exceeded The 2.5 percent inflation target of the National Bank of Poland. This state of affairs continues for over 5 years. The last time inflation the base was within this target in October 2019. It is worth also note that some other measures are still high core inflation. For example, the indicator after excluding the most volatile prices was 4.6%, and the 15% mean cut-off was 3.9%.

- The National Bank of Poland calculates four indicators every month core inflation, which helps to understand the nature of inflation in Poland. CPI shows the average change in prices of the entire large basket of goods purchased by consumers. When calculating core inflation rates, the following are analyzed: price changes in different segments of this basket. This allows for better identification sources of inflation and to forecast its future trends more accurately. It also allows determine to what extent inflation is permanent and to what extent it is shaped, e.g. by short-term price changes caused by unpredictable factors – we read in the NBP press release.

While "wide" consumer inflation (CPI) in April was 4.9% higher than a year earlier . This a result that includes last year's increases in energy and gas tariffs and part of the VAT increases on food. Inflation is expected to rise in Q3 CPI will be more aligned with core inflation rates.

March The projection of the National Bank of Poland assumes that core inflation will be within the 2.5 percent target only in the last quarter of 2027 (with assuming that interest rates remain unchanged). Significantly earlier – because “already” in the fourth quarter of 2026 – the “broad” inflation rate is to fall to 2.5% CPI inflation – results from the NBP's March inflation projection.

bankier.pl