Poland's gold reserves now larger than Europe Central Bank's, says Polish central bank chief

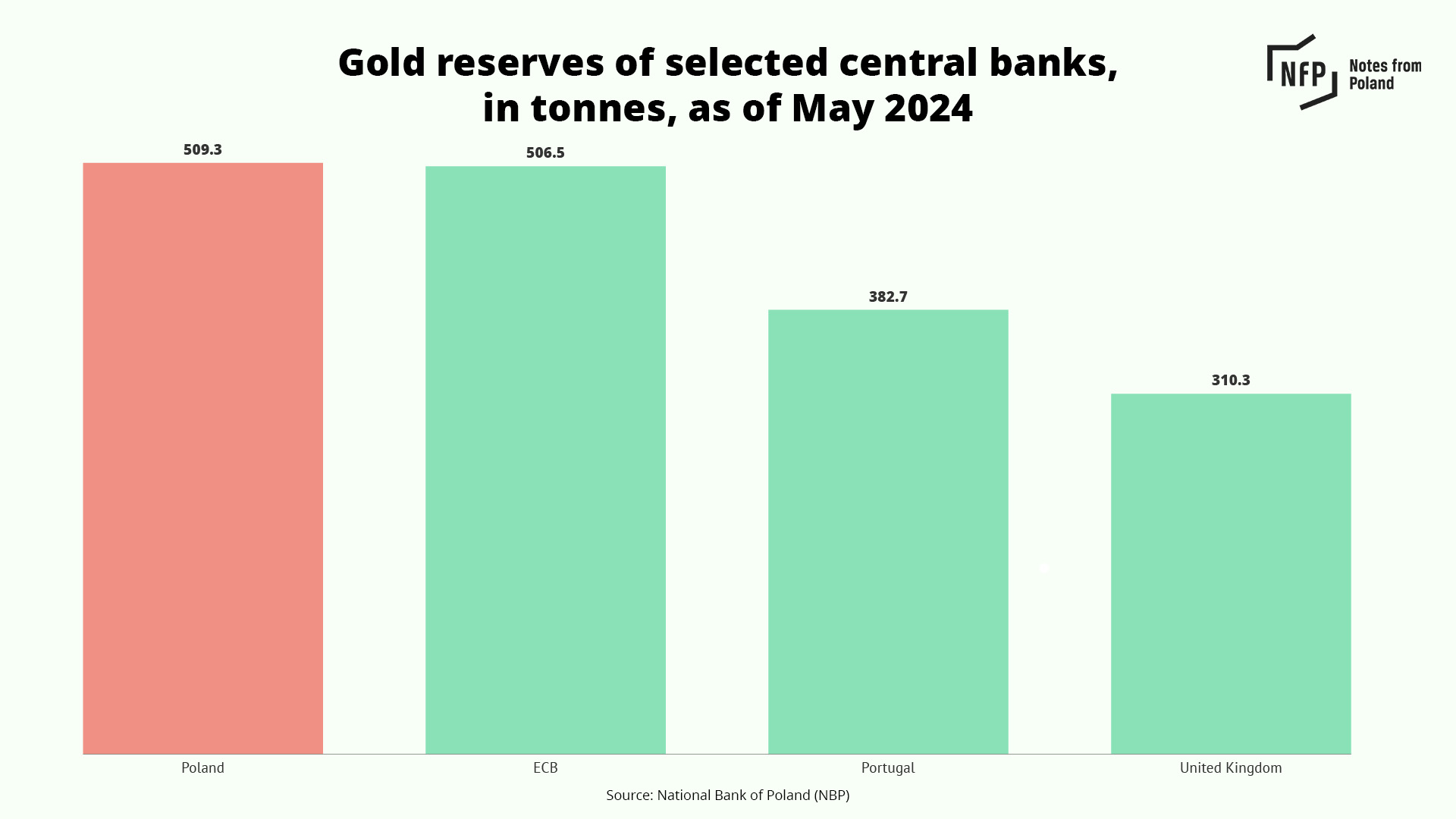

The National Bank of Poland (NBP) now holds 509.3 tonnes of gold, exceeding the reserves of the European Central Bank (ECB), says NBP governor Adam Glapiński.

“This shows the stability, abundance and solvency of the Polish economy,” Glapiński told reporters during a press conference. He sees gold as a shield against global instability and a cornerstone of economic sovereignty.

Gold now accounts for 22% of the Polish central bank's total reserves, above the NBP's 20% target, according to Glapiński, who notes that the NBP's holdings are now greater than the 506.5 tonnes of gold held by the ECB, which sets monetary policy for the Eurozone and the European Union.

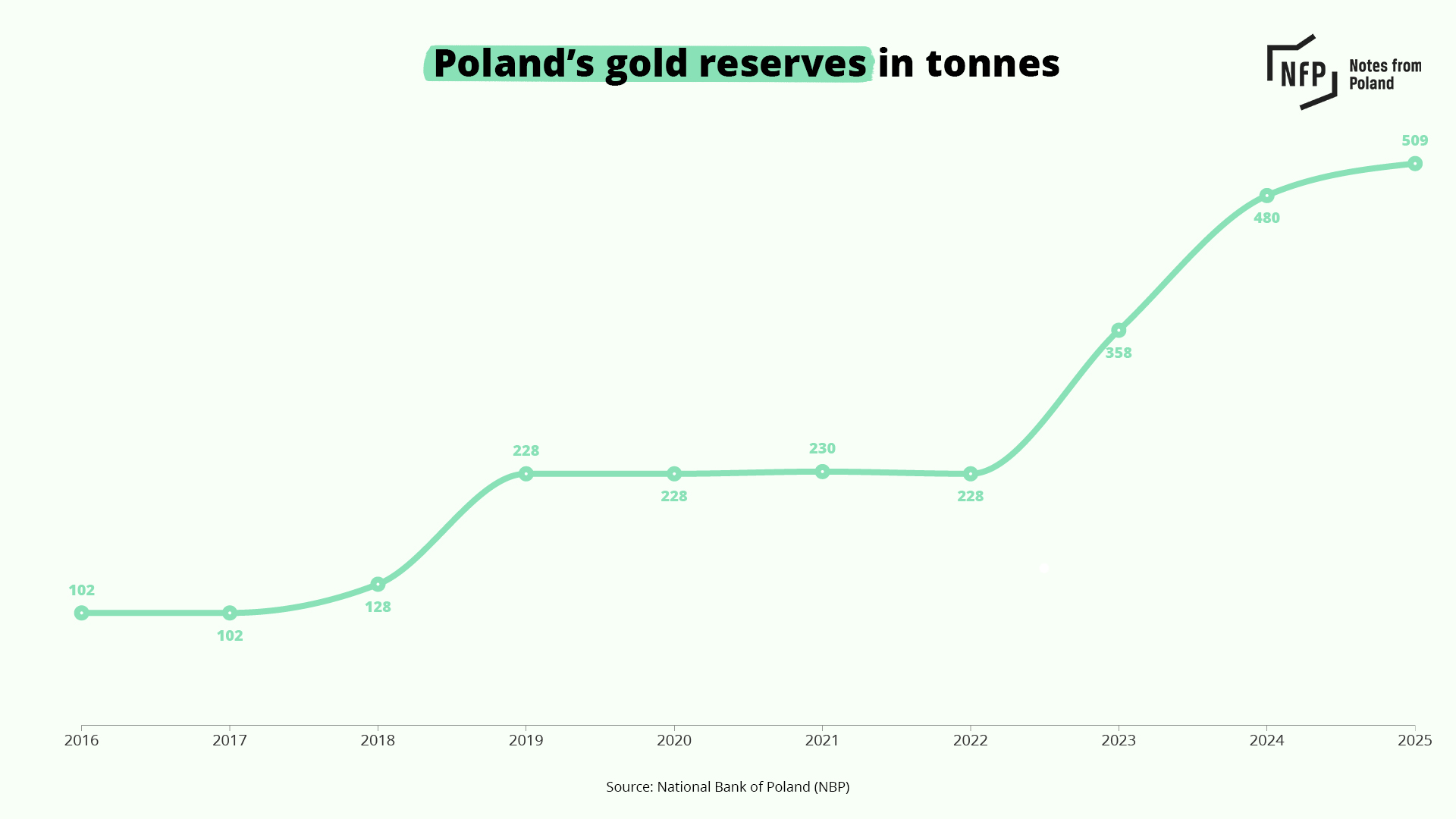

Poland has accelerated its gold accumulation in recent years. In 1996, the National Bank of Poland (NBP) held just 14 tonnes of gold. By 2016, that figure had risen to 102 tonnes. The pace of purchases increased significantly after 2022, with the NBP more than doubling its holdings from 228 tonnes to 480 tonnes within two years.

Glapiński, who became NBP governor in 2016, says the bank's gold was, by the end of 2024, worth 60 billion zlotys (€14.12 billion) more than what the bank paid for it, and the gain has continued to grow since.

The profit, however, is only on paper, he added, clarifying that the central bank does not plan to sell its gold, which, at current prices, is worth €44.3 billion.

About 20% of the NBP's gold is currently stored in Poland itself, with the remainder deposited in New York and London. Glapiński said the bank ultimately aims to hold one-third of its gold in each of the three locations for security purposes.

Earlier this week, Glapiński outlined several reasons why the central bank considers such a large gold reserve necessary. Gold remains the safest component of reserve assets, he said, noting that it is free from any direct links to national economic policies, resistant to crises, and retains its real value over the long term.

“It is a symbol of stability that enhances our credibility in the eyes of investors and foreign partners,” he told a group who won a visit to the NBP vault as part of a contest launched because, said Glapiński, “there are people who doubt the existence of the gold” that had been moved to Poland in 2019.

In a covert operation that year, the NBP repatriated 100 tonnes of gold from the Bank of England to its vaults in Warsaw. The mission, involving eight flights over several months and extensive security, moved 8,000 gold bars.

"The whole wall is loaded with bars... National wealth, we are glad that someone cares about it" - commented one of the winners of the "Golden competition for Polish families". #nbp #złotykonkurs #złoto pic.twitter.com/YbzGvFBhUH

— National Bank of Poland (@nbppl) May 7, 2025

The central bank considers gold a strategic asset in its foreign exchange reserves. According to the NBP's website, gold is not a liability and carries no credit risk, with its physical characteristics ensuring durability and near indestructibility.

The bank said gold tends to rise in value during periods of financial or political instability and supports Poland's credibility on international markets.

Main image credit: National Bank of Poland/X

notesfrompoland

![Good news about Przeworsk station [PHOTOS]](/_next/image?url=https%3A%2F%2Fzycie.pl%2Fstatic%2Ffiles%2Fgallery%2F561%2F1585819_1746460199.webp&w=1280&q=100)