$14 billion loss in Antalya tourism between Russia and Ukraine

Management Consultant and Tourism Economy writer Feti Kuyucu stated that Antalya tourism suffered a total loss of around 14-15 billion dollars due to the Russia-Ukraine war.

Kuyucu noted that travel demand from Russian Federation citizens to Turkey was the main driver of growth and change in Antalya's tourism sector after the 2000s. "During these years and beyond, new accommodation facilities and complementary sectors (primarily residential and retail tourism) began to emerge, primarily based on this growth market. The Russian Federation and CIS markets, as the primary drivers of growth, contributed to Antalya's tourism sector for many years and were the primary drivers of bed supply growth. For many years, the country, along with Germany , held a 48-52% share of foreign visitors to Antalya by nationality. In 2019, guests from the Russian Federation accounted for the highest share, comprising 36% of the total number of visitors (5,564,980 Russian guests). This is both a welcome and a concerning figure. This market concentration was encouraging at the time, but the potential for significant risks in the future was overlooked, and little effort was made to balance market diversity and the destination." He used the expressions.

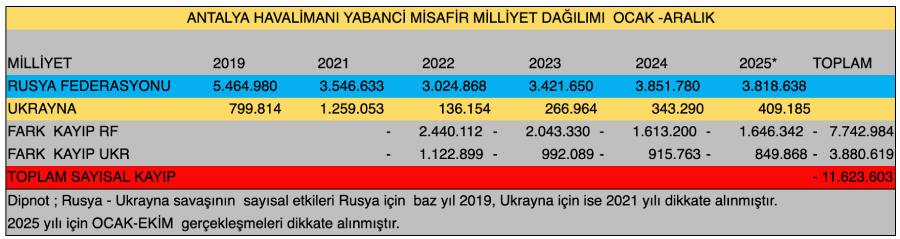

"Total loss is over 11.6 million"Kuyucu, noting that the political and geopolitical events and tensions that began in 2014 escalated into the Russia-Ukraine war in February 2022, stated, “This war caused significant disruptions in the lives of the Russian and Ukrainian people, and this environment has negatively impacted Turkish tourism, especially the summer vacation destination of Antalya, over the years. In addition to the effects of the war, the Ukrainian people struggled to survive, while Russia faced numerous economic sanctions, entering an economic downturn. Logistics links, in particular, were severed or costs increased significantly (airline sanctions). These developments significantly damaged the Antalya Riviera's position as a popular sea, sand, and sun holiday destination for Russian and Ukrainian families, a popular summer vacation destination in the Mediterranean basin. Considering the numerical losses from 2019 and beyond, the year of the highest guest numbers, the loss of guests in these two markets was reflected as 11,623,603 people/period as of October 2025.”

It was not easy to replace these two markets.Kuyucu continued by underlining the following points:

This loss of alternative guests has had a significant negative impact on Antalya's economy and employment market in recent years. The tourism sector and its sub-sectors have been negatively impacted by these developments, facing numerous financial challenges. While the sector has attempted to offset these losses with other markets, it has struggled significantly. Replacing these two markets, which account for roughly 42% of the total guest count (2019 figures), would be difficult.

Total alternative revenue loss is $14-15 billionThe accompanying table shows the potential losses of Russian and Ukrainian guests over the years. As of October 2025, the total potential numerical loss is 11.6 million people/period, and the economic losses are quite alarming.

Assuming an average package tour price is $1,000, Antalya tourism's loss of alternative revenue from these markets amounts to $11.6 billion. Taking into account holistic and complementary sectors, and particularly the retail economy, the total loss of alternative revenue is approaching $14-15 billion.

These markets will not continue like this forever and will somehow return to their former potential; however, the necessity of establishing a homogeneous structure across all destinations has once again become a necessity, and at a high cost.

Instead of narrow market diversity, we must construct expanded/differentiated market diversity by taking into account the homogeneous structure.”

turizmekonomi