The MPC decision surprised analysts. The Council cut interest rates

This time the Monetary Policy Council surprised analysts, cutting NBP interest rates by 25 basis points. Economists quite widely expected that they would remain unchanged until the next interest rate cut. the zloty will only arrive in September.

By decision of the Monetary Policy Council published on July 2 2025 The interest rates of the National Bank of Poland will be as follows: as follows:

- reference rate 5.00% per annum;

- Lombard rate 5.50% per annum;

- deposit rate 4.50% per annum;

- bills of exchange rediscount rate of 5.05% per annum;

- bill discount rate 5.10% per annum.

- Although most economists are betting on leaving rates at an unchanged level, market valuations are however leaning towards their a 25 basis point reduction – this is what they wrote before the Council's decision was announced PKO BP economists. As it turned out, the cut was made despite the consensus of analysts' forecasts clearly indicating that it would not happen. 3 out of 29 surveyed economists were betting on a cut.

At the previous meeting of the Monetary Policy Council, the decision was made to keep interest rates unchanged. levels . In May, the Council decided to a strong 50-basis-point cut after a 17-month break in cost reduction credit. A month ago, economists quite widely expected that the Monetary Policy Council would cut rates also in July, but the June conference of the NBP president dispelled these hopes and base the scenario was to return to the reduction cycle at the September Council meeting (in In August, the Monetary Policy Council meets only for a one-day, “non-decision-making” meeting).

- We believe that the chances of a rate cut in July are low and a correction in September is more likely. However, this forecast is still strongly similar to a coin toss and the votes will probably have to be counted in the following days - they wrote mBank economists comment on the June speech of the NBP President.

It is worth adding that the Council members already had July inflation projection of the National Bank of Poland. The most important results We should learn about this report in the official statement of the Monetary Policy Council, which is to be published published at 16:00. We will probably get the full content of the July screening in a few days.

The CEO's press conference on Thursday may also be important. NBP Adam Glapiński. In recent years, this has been the tone of the chairman's statements The Council shapes market expectations about the future level of interest rates. interest rates in Poland. President Glapiński should discuss the results of the July projection and explain the reasons behind the July reduction in NBP rates.

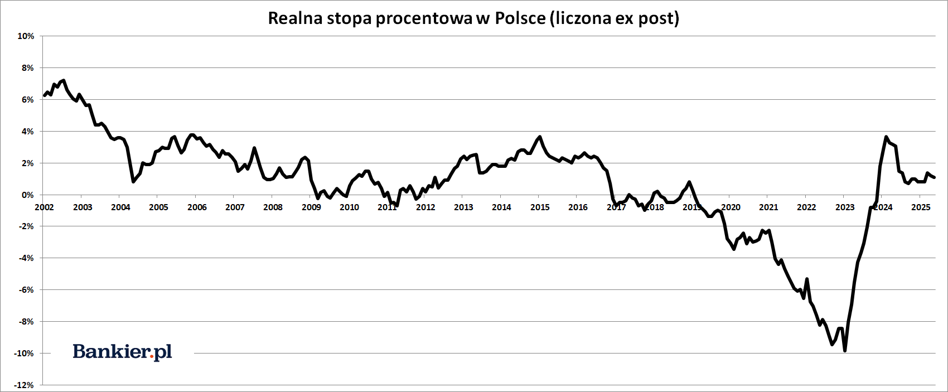

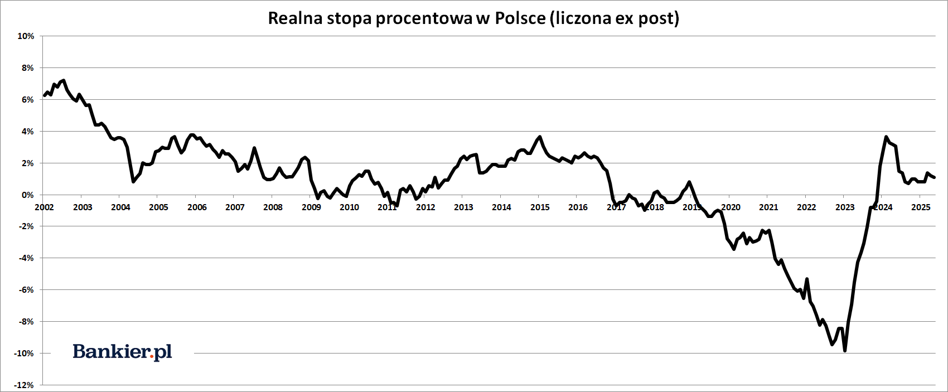

Poland with real positive interest ratesFor a year and a half, the Monetary Policy Council has been resisting market pressures and political pressures demanding a significant easing of monetary policy. NBP interest rates were kept unchanged throughout 2024 year and the first months of the current year. As a result, for a year and a half, the real the interest rate in Poland (calculated ex post) is positive. That is, the rate NBP reference rate exceeds CPI inflation for the previous 12 months.

This state of affairs is not obvious. In the years 2017-24 we were dealing with the policy of real negative interest rates of the NBP, when they were deliberately kept below CPI inflation. In 2021-23, real interest rates in Poland were deeply negative in real terms, reaching as much as -10%.

The reaction of the zlotyAfter the unexpected interest rate cut by the Monetary Policy Council, the Polish currency weakened. At 16:10, the złoty lost 0.86% against the dollar. At the same time, the euro was strengthening against the Polish currency by 0.45%.

The Polish currency weakened against the main currencies on Wednesday after the announcement of the Monetary Policy Council's decision to cut interest rates; the dollar was worth around PLN 3.62, the euro PLN 4.26, and the Swiss franc PLN 4.57.

bankier.pl