Bloody red banks, disastrous situation in German industry and the US budget growing in debt

No investor was likely expecting such a thrilling end to the week. A bank carnage on the Warsaw Stock Exchange, dismal data from German industry, and persistently expensive fuels – these were the headlines on Bankier.pl on Friday alone. We invite you to read a recap of this memorable week.

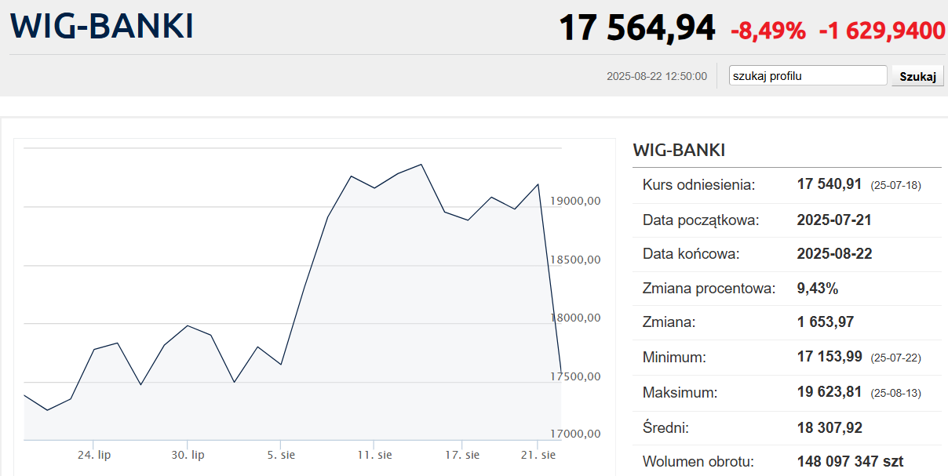

The beginning of Friday's session brought a sharp decline in bank stocks, which only deepened halfway through. Pekao and PKO BP are losing ground in response to government plans to introduce a tax surcharge for the banking sector.

July data from the Polish labor market indicated a sharp slowdown in nominal wage growth and an unexpectedly deep reduction in employment. This gives the Monetary Policy Council the green light for a September interest rate cut.

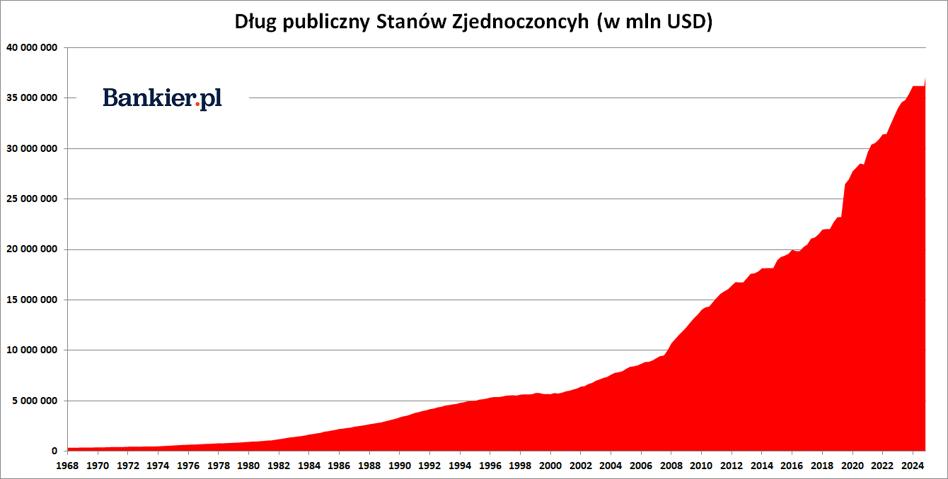

Donald Trump's "Big Beautiful Bill" raised the national debt ceiling, which the White House immediately capitalized on, increasing the American debt to over $37 trillion. This is a symptom of the only superpower's insane addiction to other people's money.

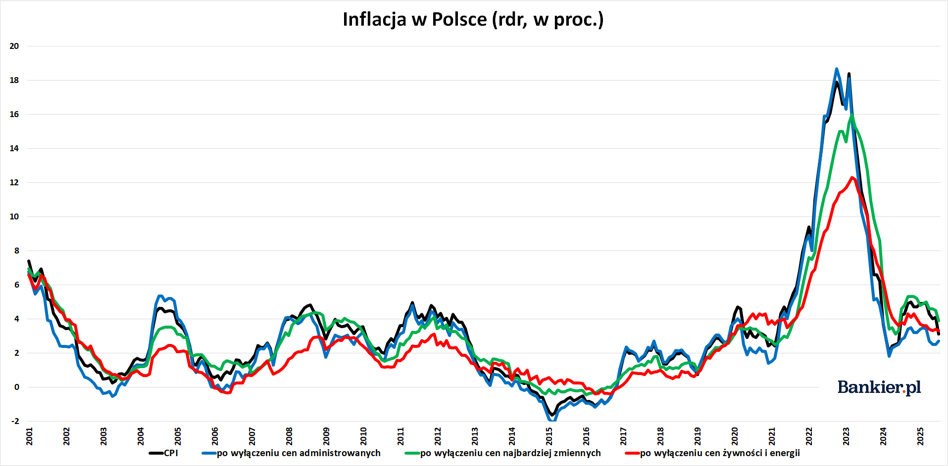

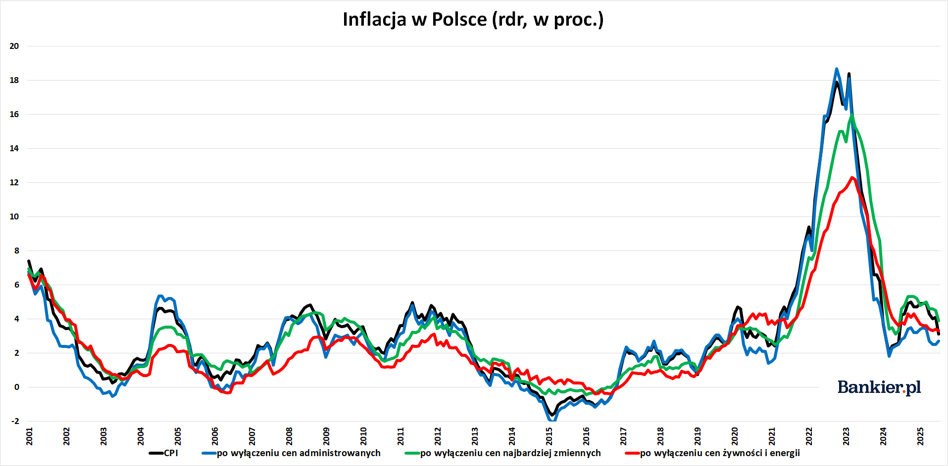

Although the CPI inflation rate fell close to the National Bank of Poland's (NBP) inflation target, many consumer goods continued to rise in price at an unacceptable rate. Therefore, we are returning to the publication of "inflation hits" – the fastest-rising goods and services.

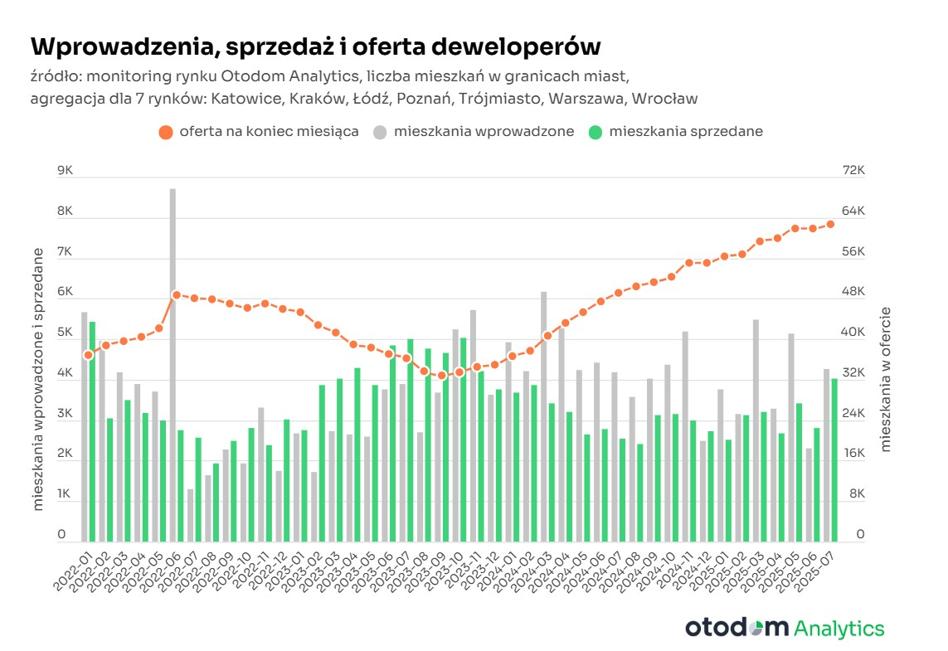

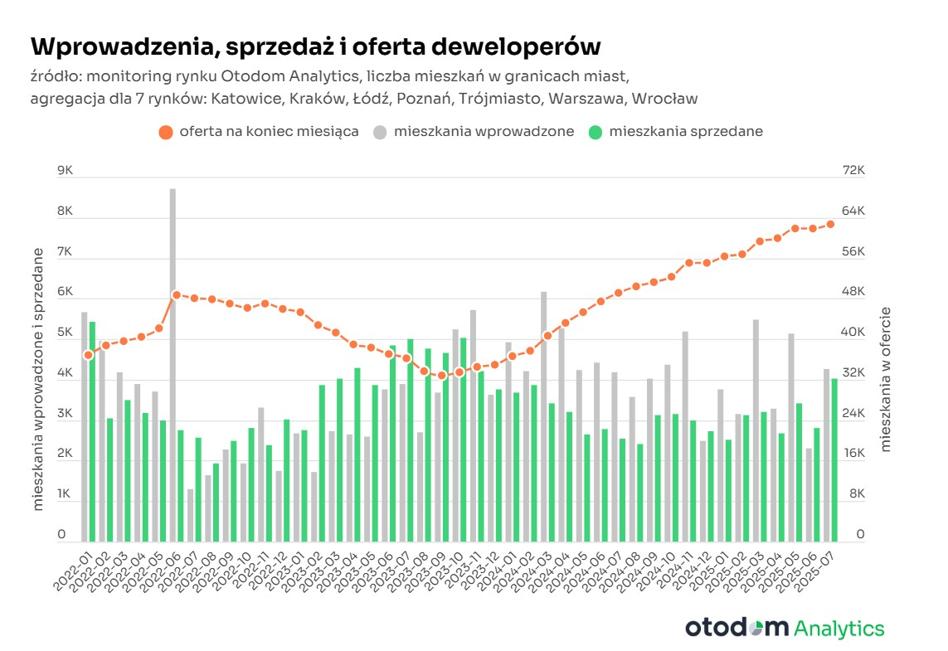

In July, developers operating in Poland's seven largest markets sold over 4,000 apartments – the highest number since they began to manage without the support of mortgage subsidies, according to Otodom Analytics. However, more apartments are still being added to the market than are being removed.

July brought an expected decline in most core inflation measures in Poland. However, it still exceeds the National Bank of Poland's (NBP) 2.5% target, although it has been within the acceptable deviation range for several months.

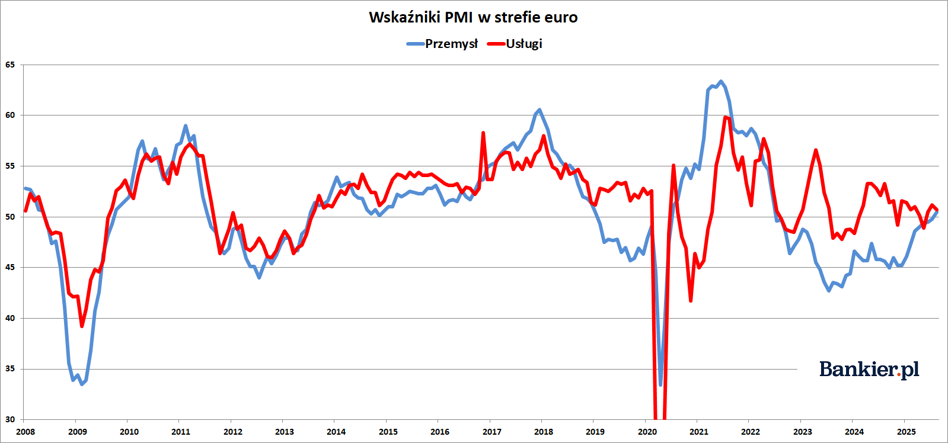

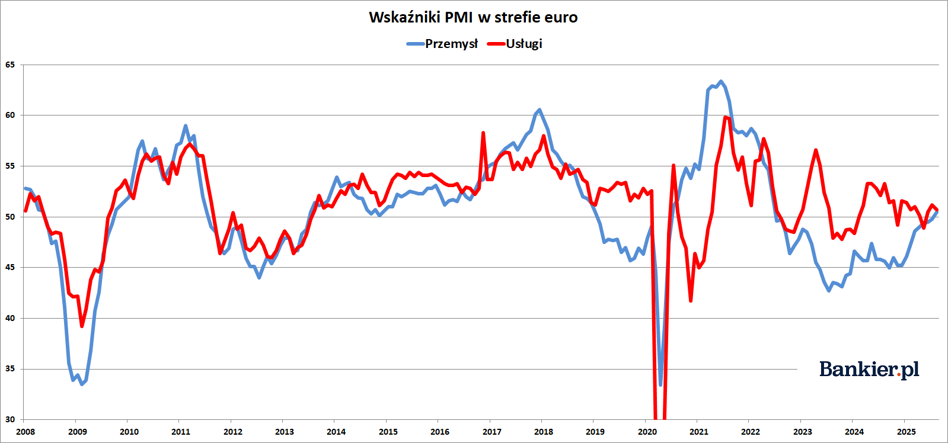

We finally got there. For the first time since June 2022, the PMI for the eurozone manufacturing sector exceeded the 50-point mark, indicating a slight increase in economic activity in the sector.

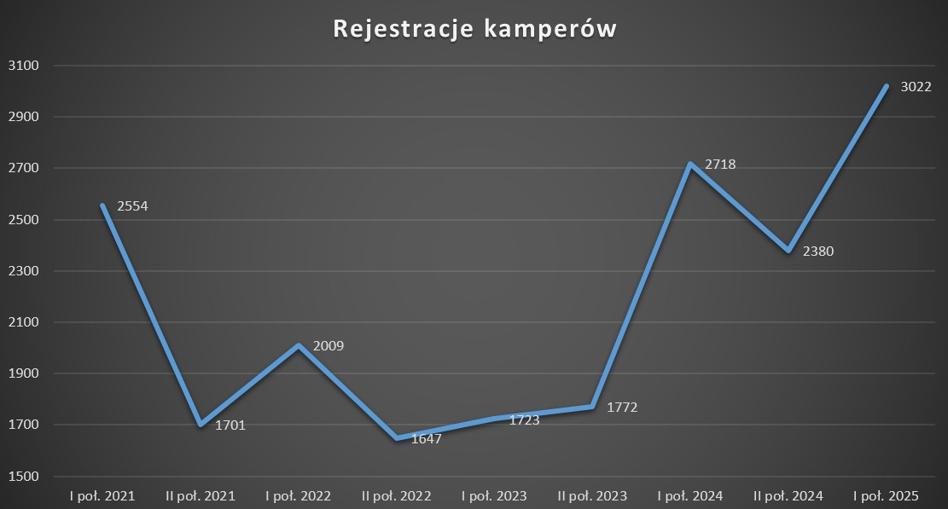

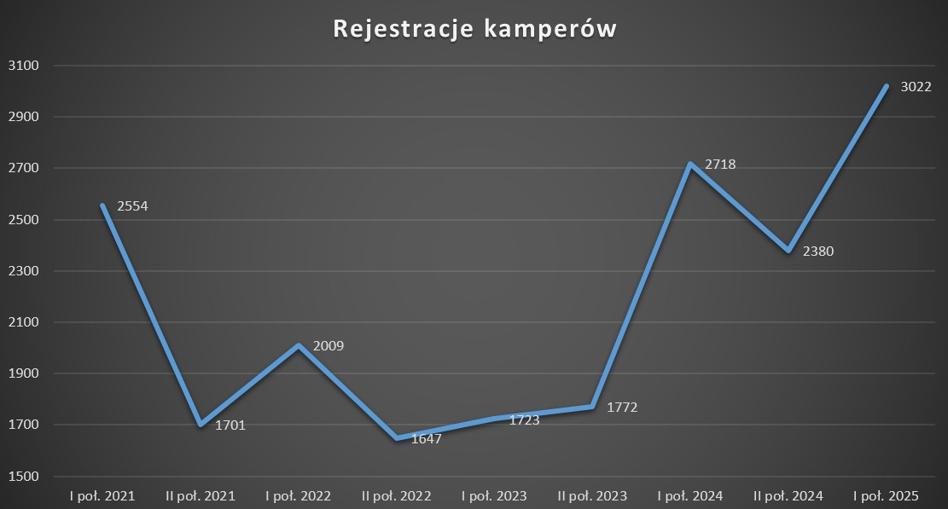

Both the second quarter of 2025 and the entire first half of the year saw the highest number of campervan registrations in Poland on record, according to data from the Polish Automotive Industry Association. Unlike during the pandemic holidays, this time Poles primarily focused on second-hand motorhomes.

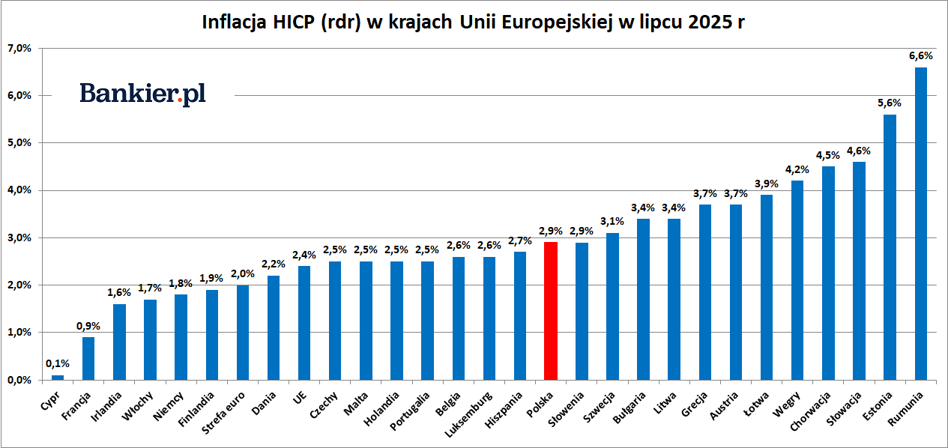

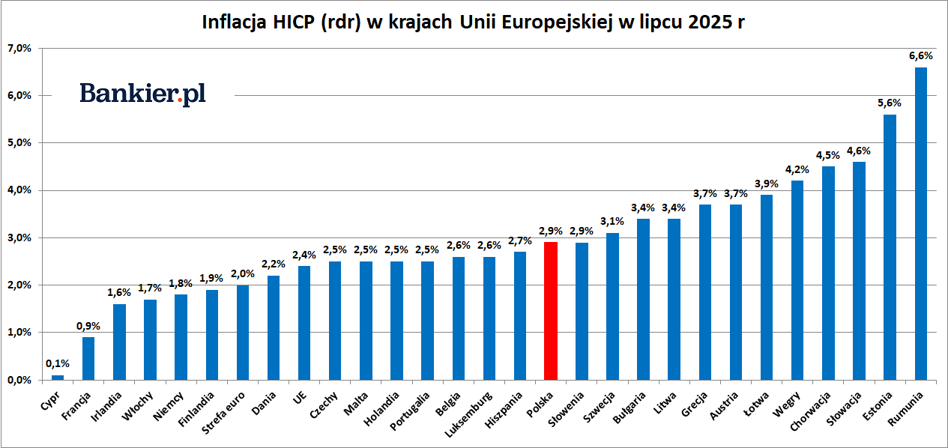

Although HICP inflation has fallen below 2% in the largest European Union economies, it remains excessively high in 21 of the 27 EU countries. The worst-hit situation is in Romania, where the inflation situation deteriorated significantly in July.

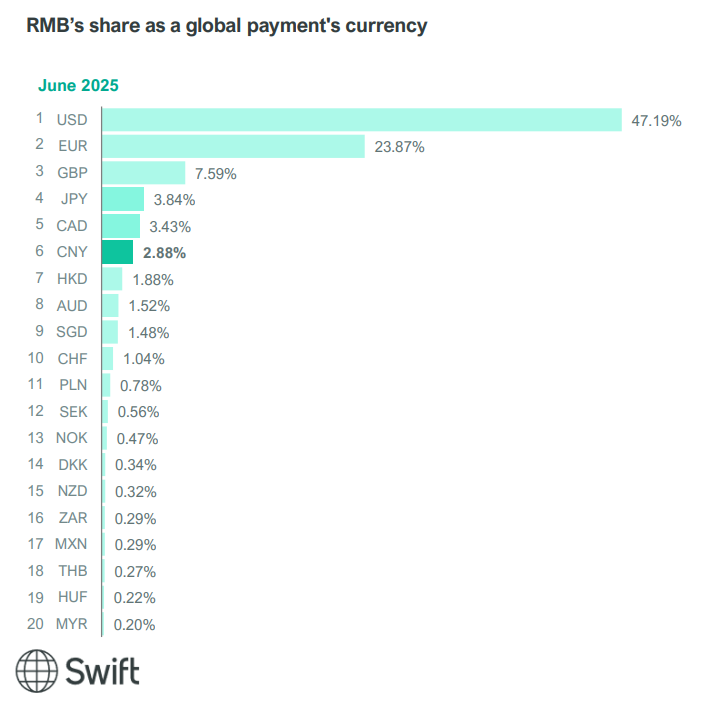

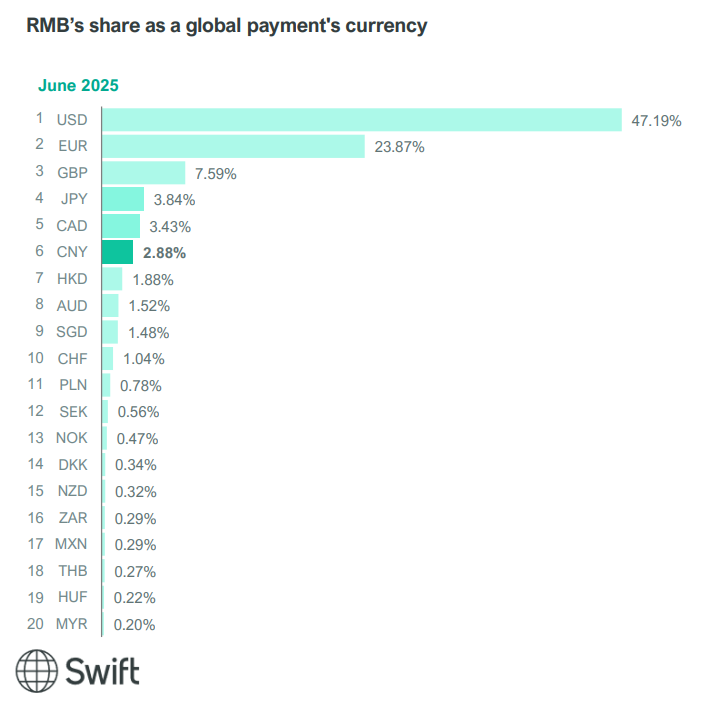

At the end of the month, China's State Council is expected to approve a plan aimed at strengthening the global use of the yuan. One of the points of the new strategy, Reuters reported, is approval for the issuance of stablecoins backed by the Chinese currency.

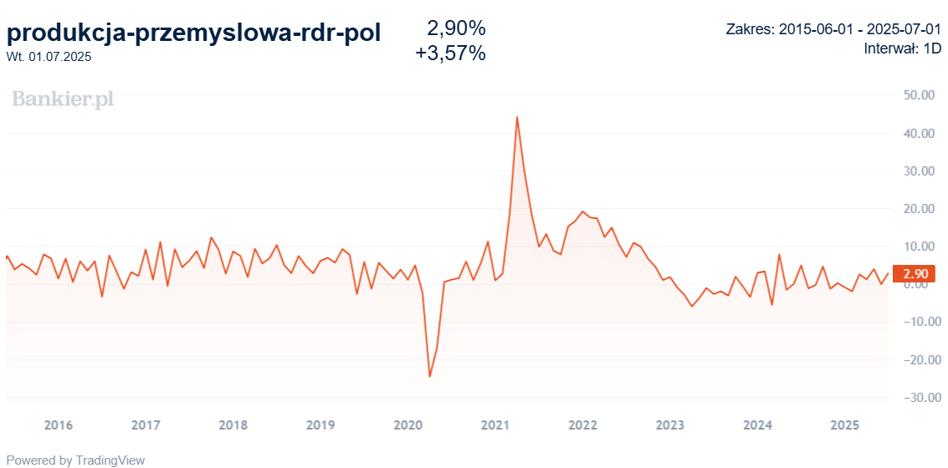

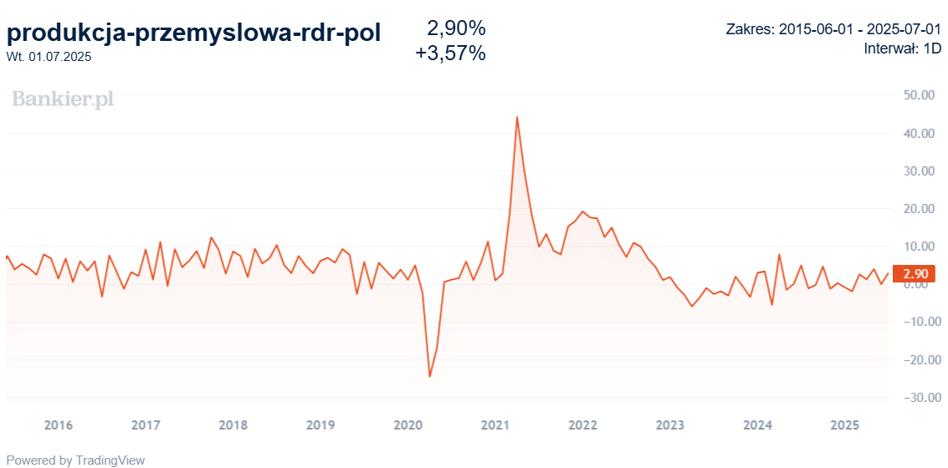

For the first time in many months, the growth rate of Polish industrial production surprised economists on the upside. However, it is still below the highs of 2021 and 2022, and while this is better than expected, we still cannot declare an end to stagnation.

bankier.pl