An exceptional quarter for developers, the bitcoin price exploded and Orlen broke PLN 100 billion

We're wrapping up a turbulent week, not just in terms of weather. Financial markets are flexing their muscles—Bitcoin is at a peak, Orlen's capitalization is swelling, but mortgages in Poland are still among the most expensive in the EU. We invite you to our economic summary of the week in charts.

Bitcoin prices continue their rally, reaching all-time highs, followed by other cryptocurrencies. The massive market rally has forced many investors to close leveraged positions.

On the Warsaw Stock Exchange, Orlen was valued at over PLN 100 billion for the first time in history. The multi-energy champion is currently the most valuable Polish company and the third in history to break the symbolic barrier. Where does the Polish giant's valuation place it among the largest companies on global stock exchanges and in the EU?

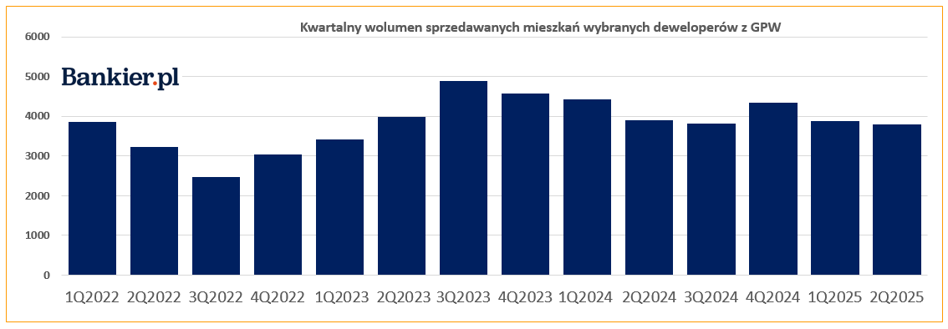

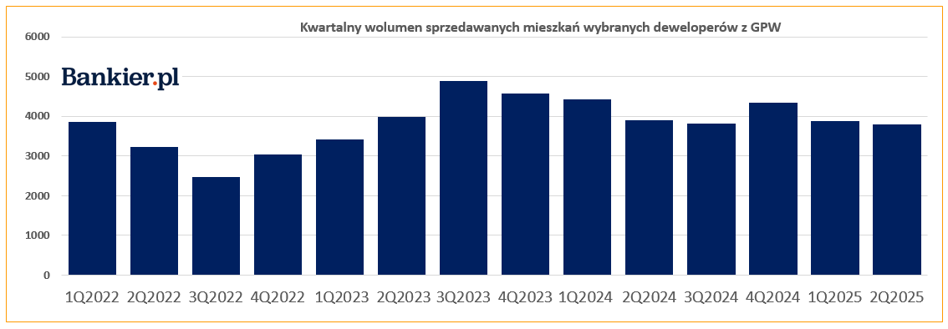

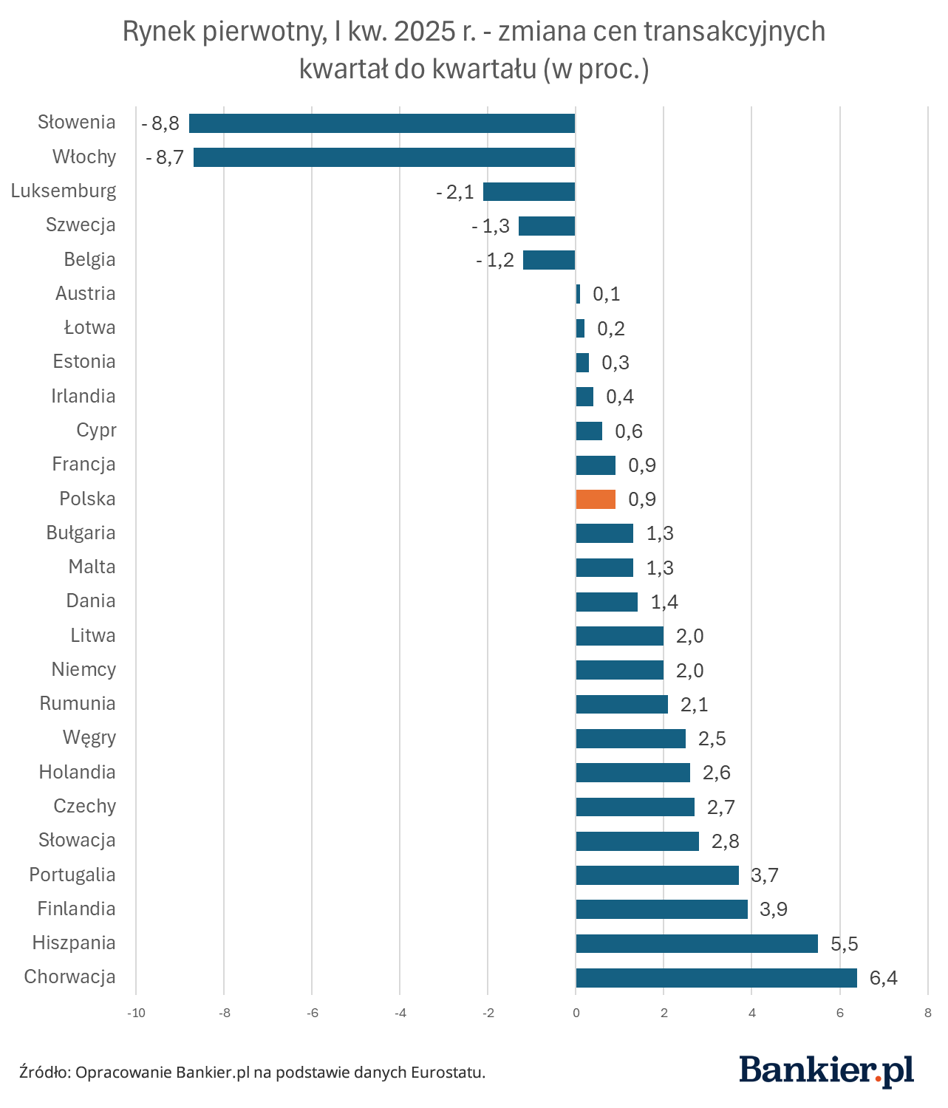

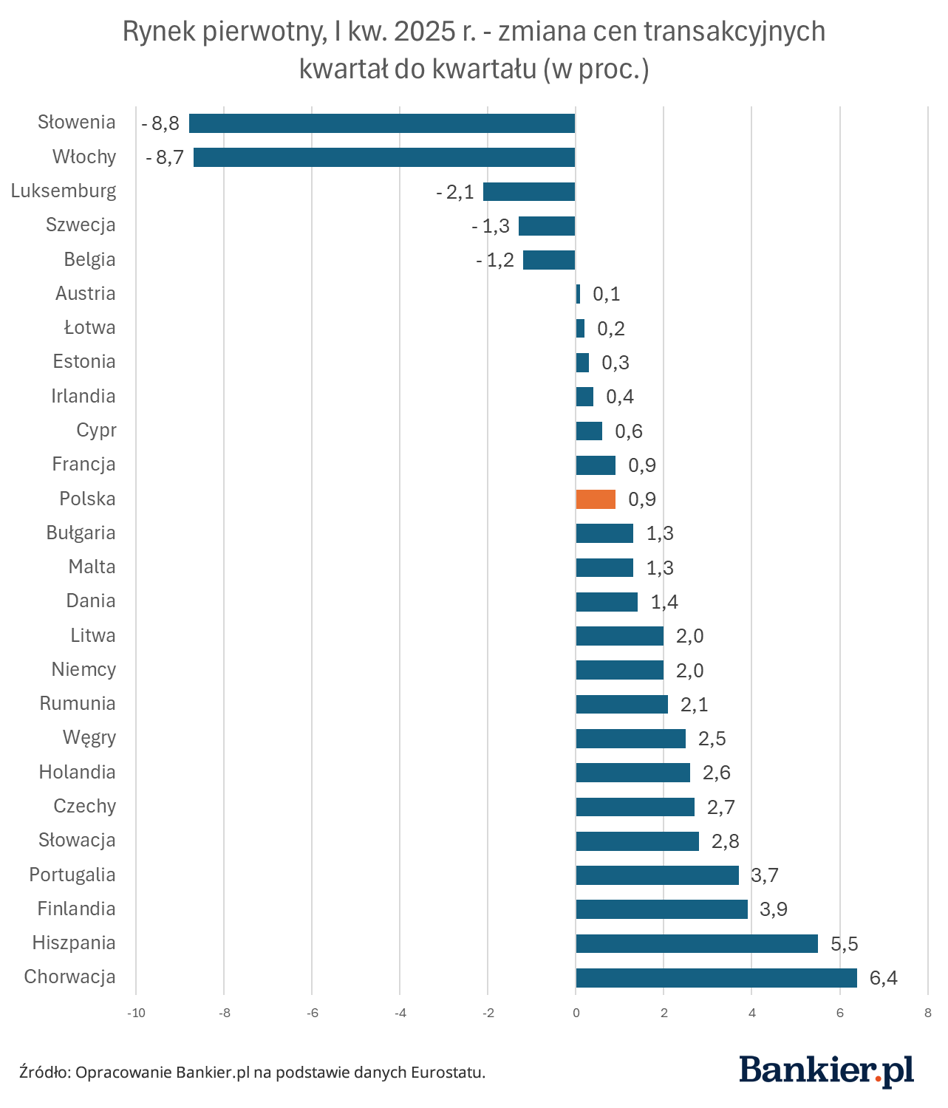

This was a unique quarter for developers, as it saw the first interest rate cut since 2023. Whether and how the May cut impacted the number of real estate transactions is partially revealed by data from the largest development companies listed on the Warsaw Stock Exchange. The CEO of one of the market leaders complained that mortgages in Poland remain expensive compared to the EU.

JSW, a company listed in the mWIG40, has released selected estimated operating data for Q2 2025, indicating a significant increase in production and slightly improved sales. Unfortunately, the company's revenues remain under pressure from falling coal prices.

As recently as Q3 2023, year-on-year real estate price increases in Poland were among the highest in the European Union. The latest Eurostat data tell a different story. In one comparison, our market is near the top, but when we rank the data from the lowest growth rate.

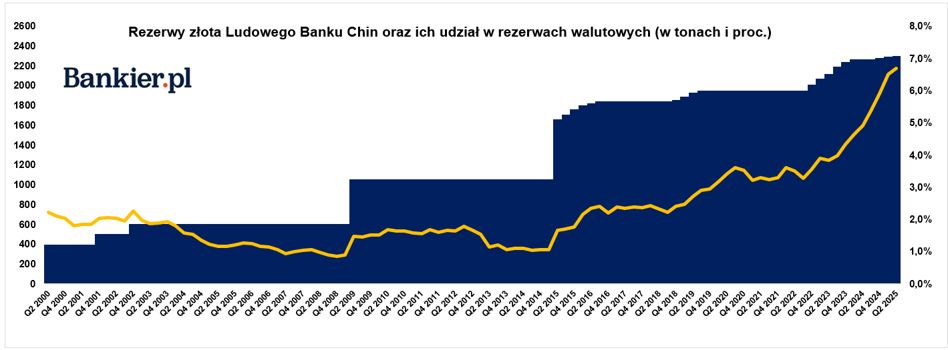

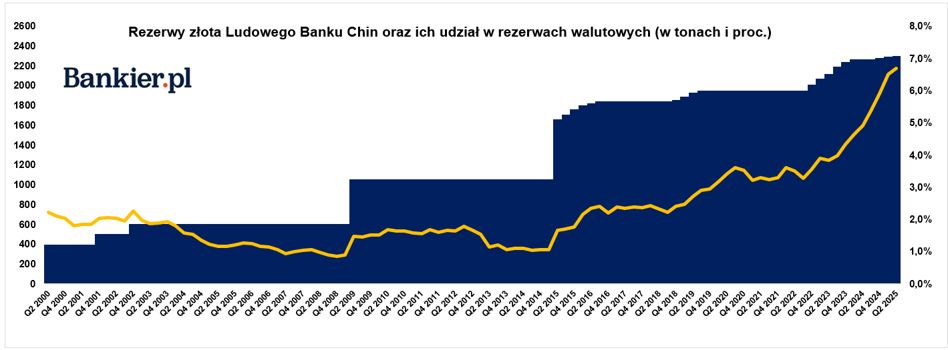

June marked the eighth consecutive month in which the People's Bank of China (PBOC) was active in the gold market. Official gold holdings increased by more than 2 tons, but their share of total foreign exchange reserves remains the smallest among the leading gold-rich countries.

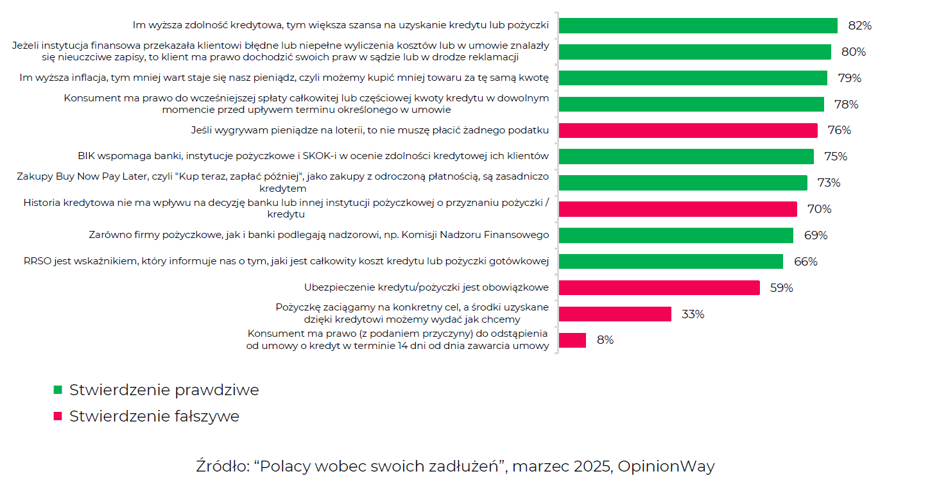

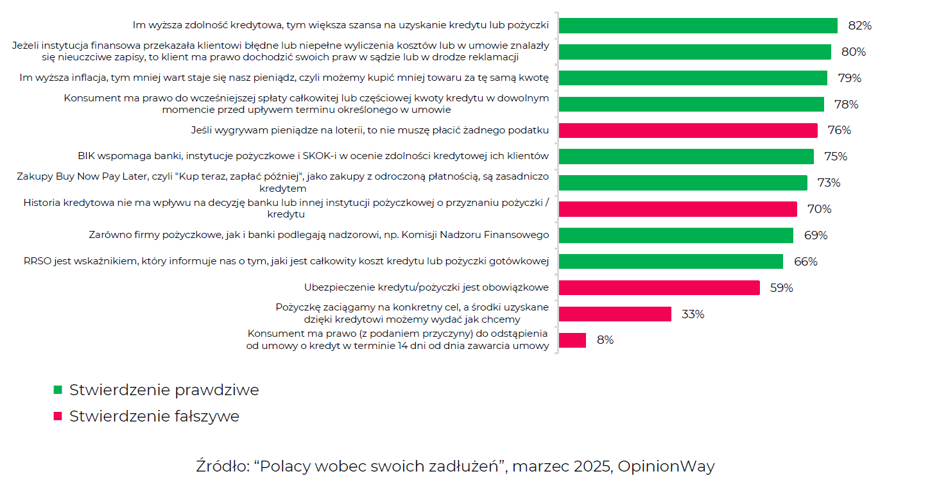

A study by the Consumer Federation shows that a staggering 91% of Poles have no problems repaying their debts. Although we borrow primarily for unexpected expenses, only one in five respondents does so due to lack of funds. Poles incur debt consciously, but their financial literacy is mediocre.

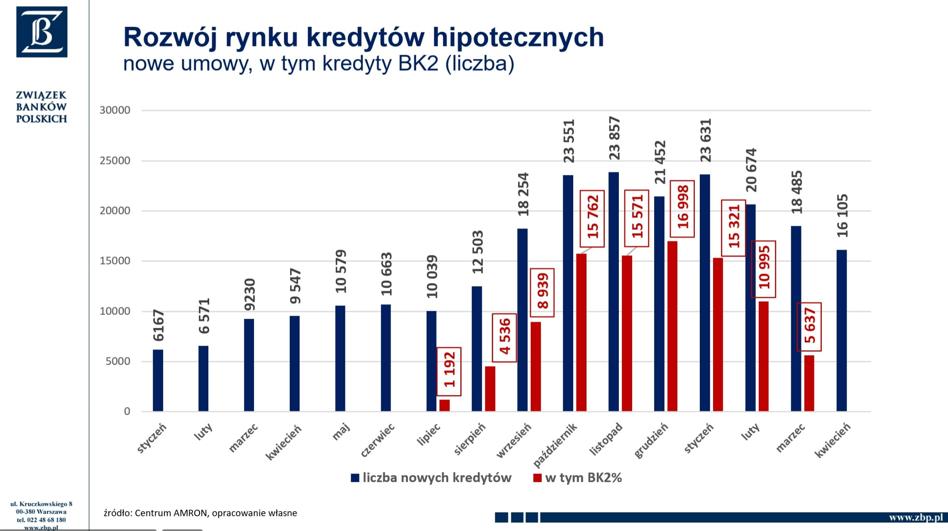

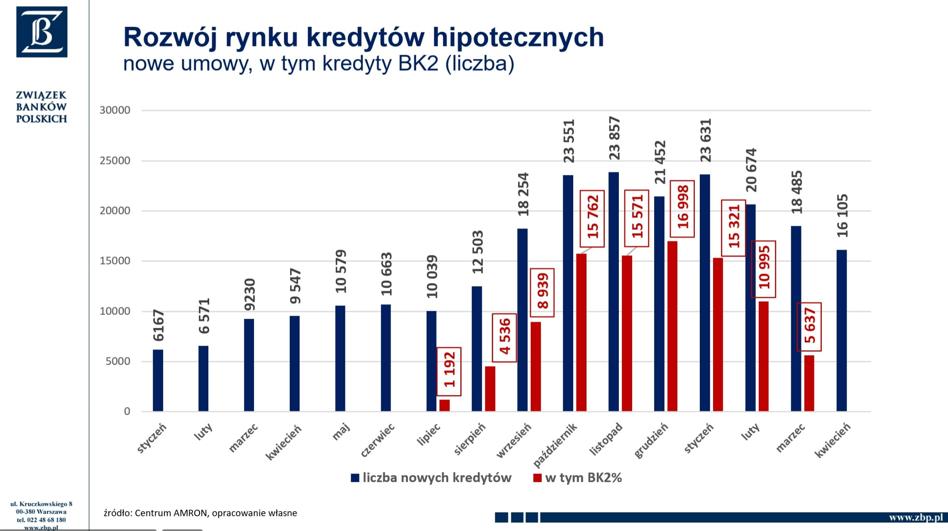

In July 2023, the first banks began accepting applications for subsidized mortgages. Few expected the program's short lifespan and far-reaching consequences.

bankier.pl