A new peak of the bull market on the WSE, the Monetary Policy Council surprised analysts and a serious accident in the Polish industry

Half a year has already passed like one day. By the way, we have entered the holiday season, but that does not mean that the economy has fallen asleep. There were a few surprises in the past week - traditionally, we invite you to a summary of the last few days on charts.

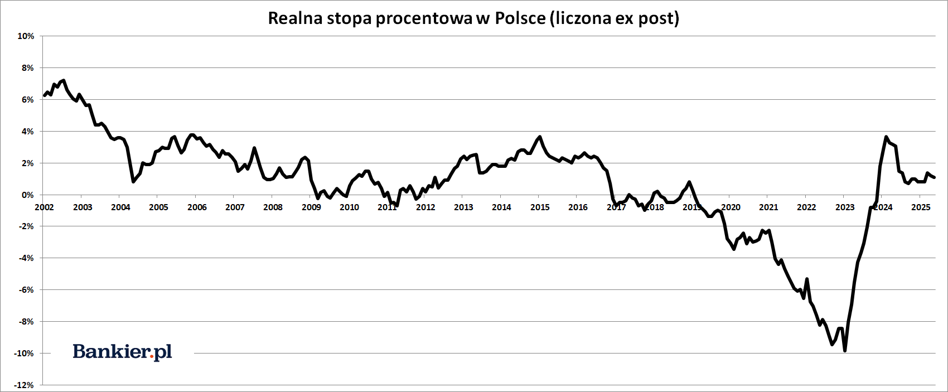

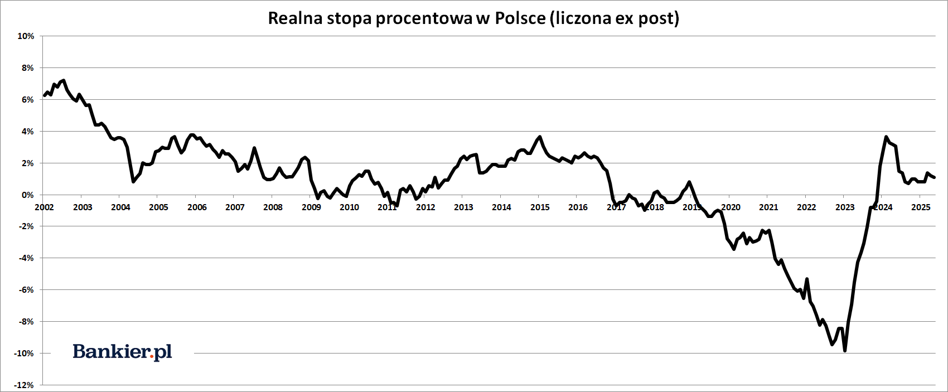

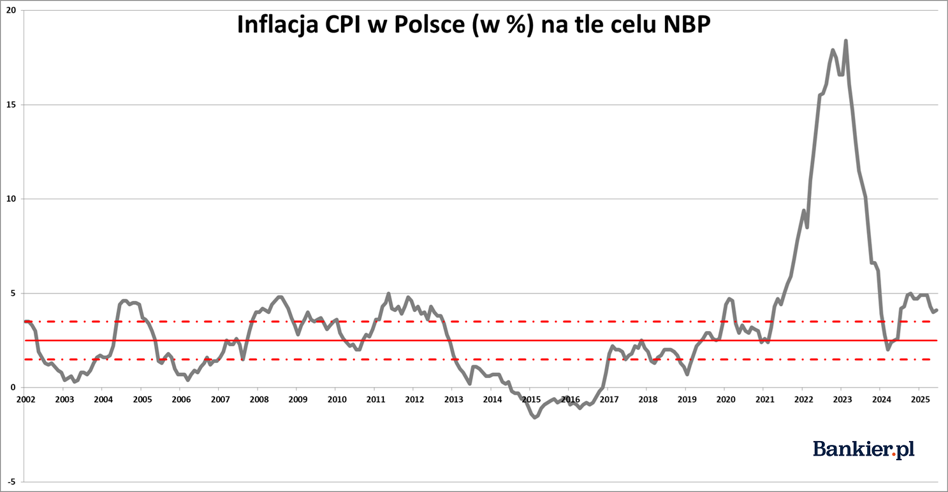

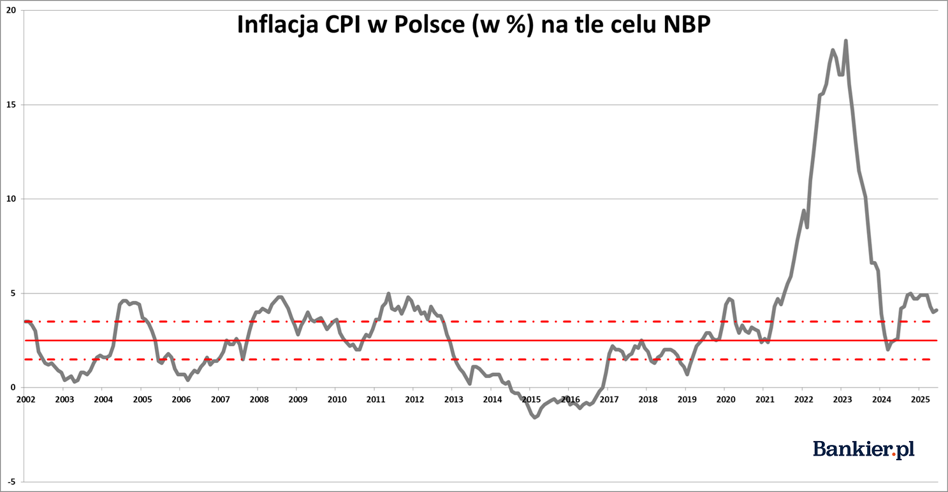

This time, the Monetary Policy Council surprised analysts by cutting NBP interest rates by 25 basis points. Economists had quite widely expected them to remain unchanged, and the next reduction in the zloty interest rate would not occur until September.

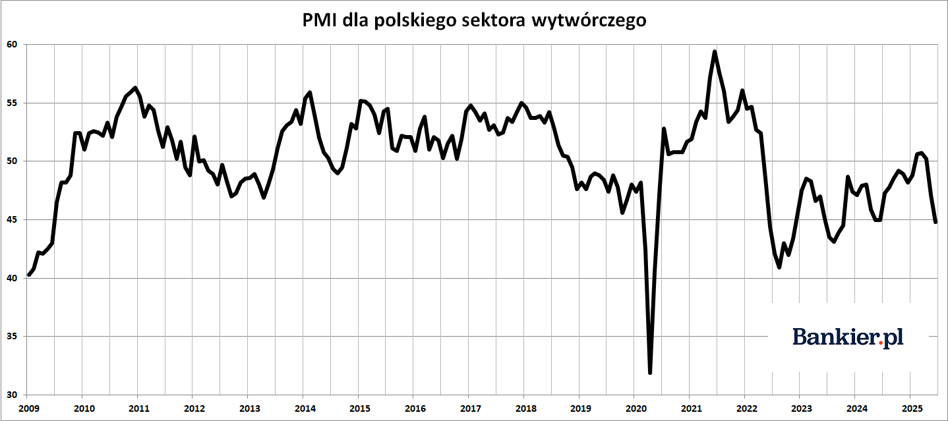

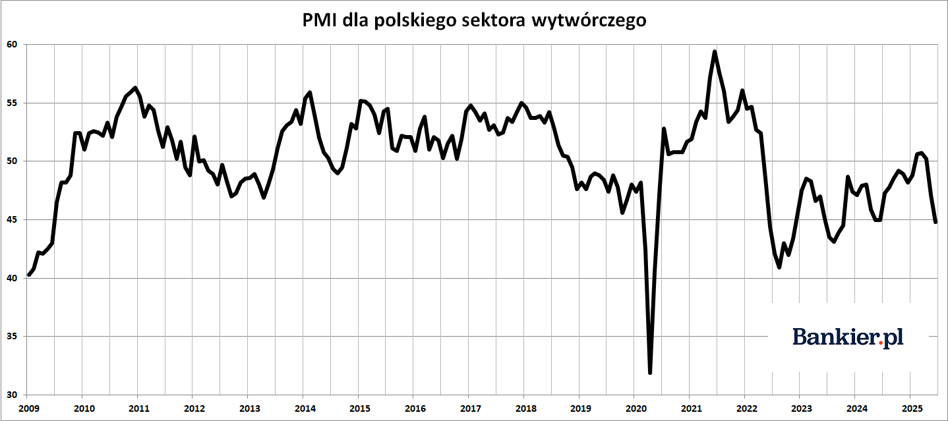

No one expected such weak data. The June PMI reading for the Polish manufacturing sector indicated a slump in the economy and a return to recession. Time will tell whether this is just an “incident at work” or a more permanent decline in production.

Not on Friday, but on Thursday, the US Bureau of Labor Statistics released its monthly report on the employment situation in the US economy. The higher number of new jobs and the drop in the unemployment rate surprised economists. The new data is being closely watched by the Fed, which will make a decision on interest rates at the end of July.

WIG improved its historic record on Thursday, and WIG20 set the highest closing price in 14 years. The growth on the WSE was supported by the situation on Wall Street, where records were also broken.

The New York Stock Exchange set new all-time highs in a strong move following a very weak jobs report. In the meantime, the Fed’s July rate cut seems to have been dropped from the table.

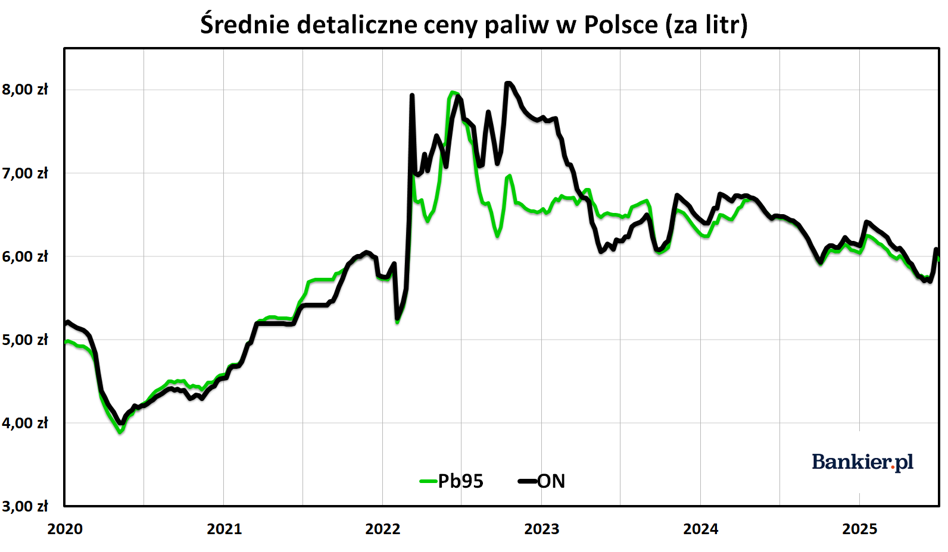

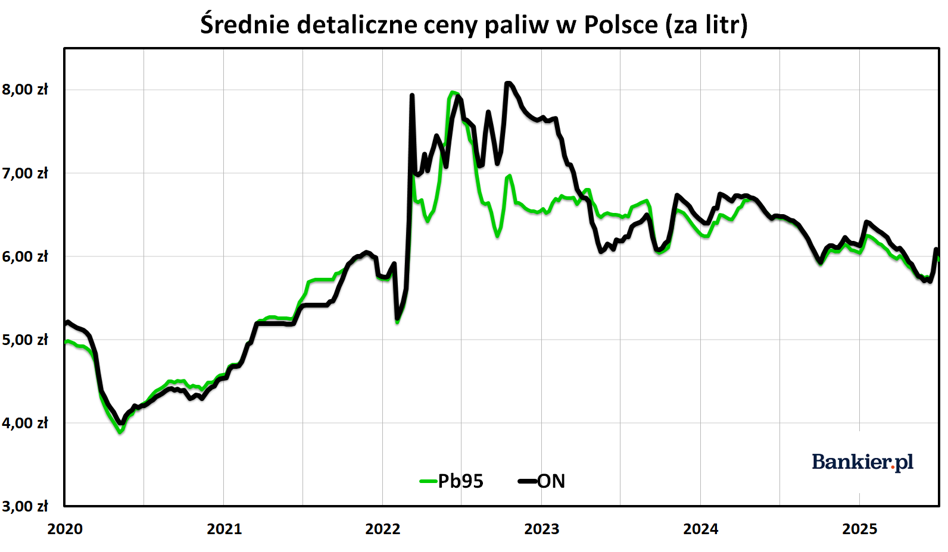

The beginning of July brought a slight drop in prices at petrol stations. However, looking at wholesale rates, it is hard to escape the belief that in the case of petrol, the process of normalizing retail prices is taking place much too slowly. On the other hand, autogas was the cheapest in almost a year.

In June, CPI inflation was slightly higher than in May, according to a flash estimate from the Central Statistical Office. Despite lower fuel prices, the consumer price index continued to grow faster than the National Bank of Poland's policy assumes.

On the one hand, single-family houses are still rising in price more slowly than they were six months ago, with annual increases of around 10 percent, according to Bankier.pl data provided by Cenatorium. On the other hand, the pace of increases is still more than twice as high as the growth in apartment prices, and the rising costs of building a house are even several times higher.

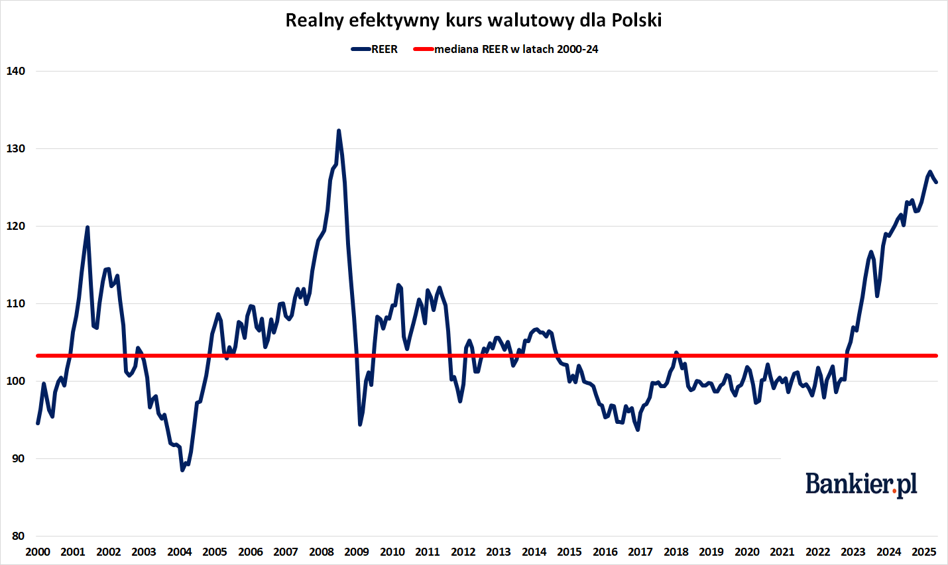

9. Will new iPhones be record-breakingly cheap? It's all because of the dollar exchange rateThe calendar already shows July, so there are a little over two months left until the premiere of new phones with a bitten apple. Until now, Apple smartphones have been associated with high prices, and rightly so, and for many Poles they were an unattainable or hard-to-get good. However, everything can change, and prices may drop in September, primarily due to the dollar exchange rate.

|

Model |

Price (USD) |

Price at the exchange rate of 3.59 (PLN) |

Price with 37% markup (PLN) |

Price of the previous model (PLN) |

Estimated price (PLN) |

|---|---|---|---|---|---|

|

iPhone |

799 |

2868.41 |

3929.72 |

3999 |

3999 |

|

iPhone Pro |

999 |

3586.41 |

4913.38 |

5299 |

5199 |

|

iPhone Pro Max |

1199 |

4304.41 |

5897.04 |

6299 |

6199 |

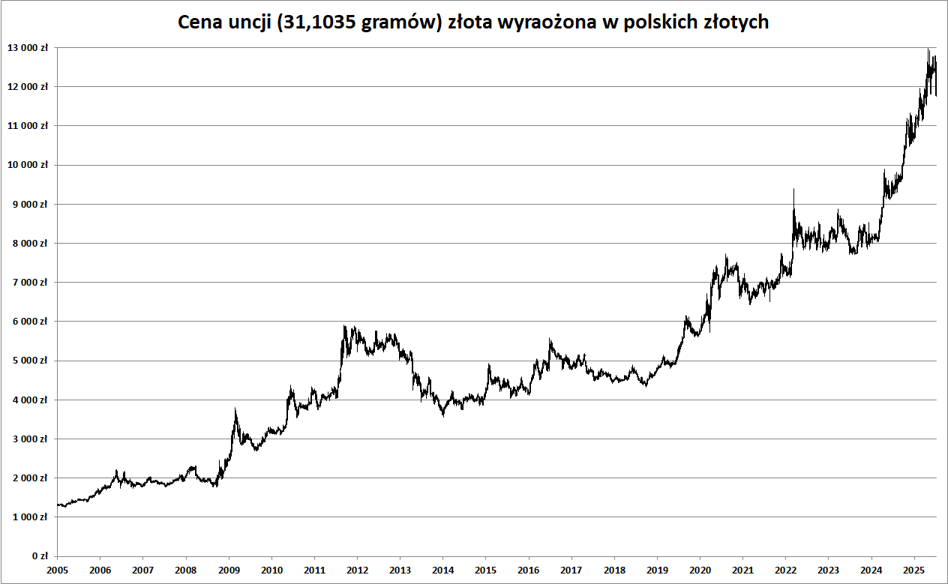

Since April, gold prices have not been setting new highs. The market is in a correction. For now, it is quite "flat", but it has a chance to deepen. However, this does not change my belief that the gold market is in a secular upward trend.

The first half of AD 2025 was full of market events. Quite unexpectedly, Poland found itself at the center of events, not only taking part but also partially creating the market trends of recent months.

bankier.pl