GUIDE: How to register as self-employed in Spain

If you plan on working for yourself or setting up a small business in Spain, you'll need to register in the 'autónomo' system. Here's our step-by-step guide on how to do this, from the forms to fill in to the government bodies you must contact.

If you’re going to work as a freelancer in Spain, as opposed to being employed by a company, you’ll need to register in what’s known as the autónomo system.

It’s important to remember that there is no legal minimum income threshold to be self-employed in Spain, so if you’re doing any regular work and getting paid for it, no matter how much it is, you should register.

READ ALSO: When exactly should I register as self-employed in Spain?

Being registered in the system means that you’ll pay monthly social security fees and also have to submit your taxes every quarter, as well as once more during the annual declaración de Renta income tax campaign from April to June each year.

Firstly, it’s important to know that there are two steps to the registration process – the first is to register with the Social Security system and the second is with the Hacienda or Treasury.

Step 1: Registering with Social Security

Registration with Social Security is done via form TA0521, which will enrol you in the RETA - the Special Regime for Self-Employed Workers.

If you have never been issued with a social security number in Spain previously, you will need to apply for one first, before you register in the RETA. This is done via form TA1 and can be done online.

Firstly, you will need to go social security website and select ‘Trabajadores’ option at the top, then click on Afiliación y Número de la Seguridad Social. This will take you to the link to apply for it online using your digital certificate.

The next step is to complete form TA0521 in order to set yourself up to pay social security. It can be done online too if you have a digital certificate here. You can also do it in person a local social security office by making an appointment first.

Find out the exact steps on how to register with social security in our handy guide here, as well as all the documents you’ll need to present or take with you.

Once you've done this you will be registered into the Social Security contribution system and will pay a monthly fee, depending on your earnings. This will cover you for healthcare, sick leave or maternity and paternity pay.

Step 2: Registering with the Tax Agency

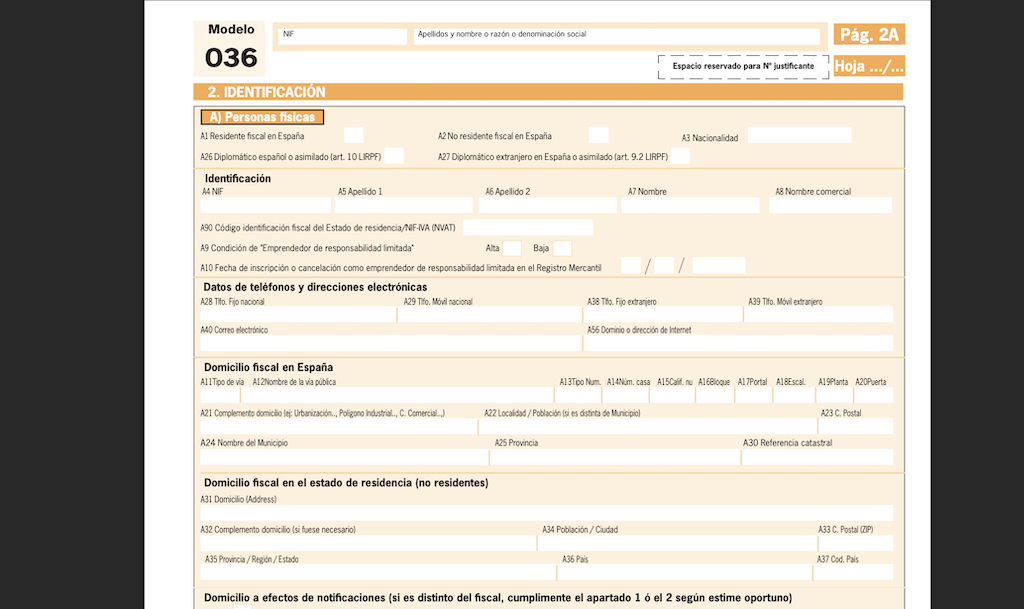

The second part of the registration process is register with the Hacienda or Treasury. To do this, you will need to complete form 036 and choose which type of business you want to carry out. This will enable you to issue invoices and pay taxes as a self-employed person. Again you can submit this online or by making an appointment and going in person to the Tax Agency.

It's worth keeping in mind that if the form can seem a little complicated if you don't know anything about the system and don't speak Spanish, so it's worth hiring an accountant, known as a gestor, to go over it with you and help you fill it out. There are also different codes you'll need to complete depending on what your profession is.

READ ALSO: What does a 'gestor' do in Spain and do you actually need one?

If you are registering for the first time, you will tick the boxes under the Alta section at the top and leave the modification B and Baja (deregistration) C sections blank.

On page two you will fill out all your personal details such as name, address and contact details. The next few pages are for professionals, so you can leave those blank too unless your gestor is helping you.

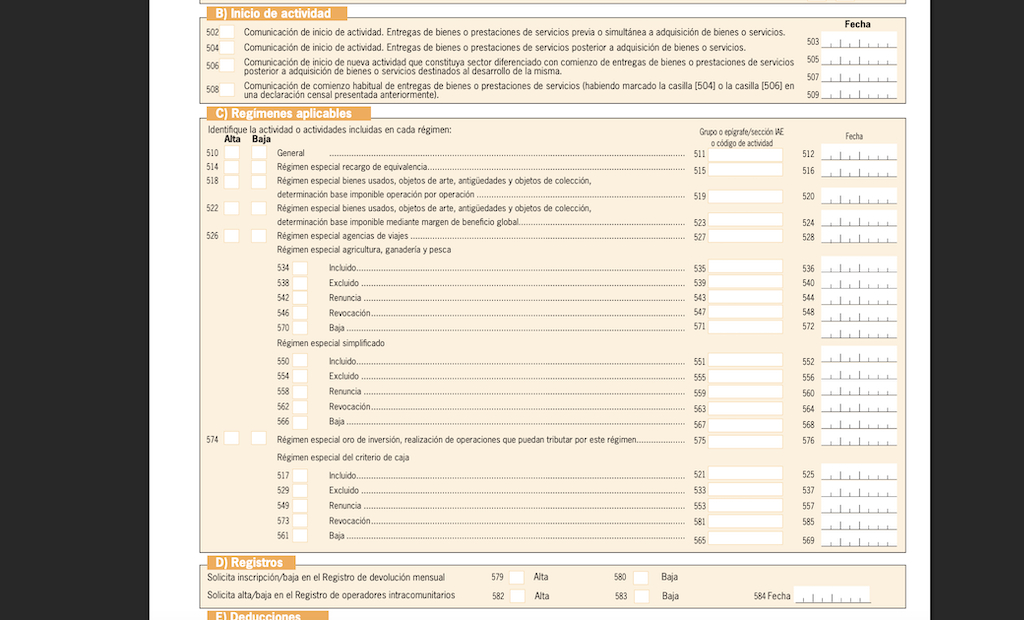

The page you will need to complete though is page 4 which asks all about your professional activity, when you will start, where it will take place. Page five again asks you about your business, if it will be a large company and what services you will offer. On this page you will also have to fill out a code or IAE based on what your business or job is going to be. This can be quite tricky to figure out because they are not the categories you’d expect them to be, especially with non-traditional more modern jobs. For example, journalist or writer falls under the artists and ceramicists category. If in doubt it’s best to ask a professional who can help you with this part.

The next couple of pages ask you about your taxes like personal income tax, society taxes as well as payments that will be made into your account. If your clients are abroad or you will be selling to clients abroad, you’ll also have to check certain boxes to say which ones they are. Page 8 is for those self-employed who are part of a society or are a professional member of a group. Finally, you’ll sign and date the form and send it.

If you have already been assigned a tax identification number, do not act through a representative, have the same address as when you previously registered, are not large companies, and do not sell products abroad, you can use the simplified version of the form 037.

Step 3: Applying for licences

Next, if you plan on opening a place of work, instead of just working from home or a co-working space, you must notify the Department of Labour of your region that you are opening a new work place.

You must also apply for the relevant licences depending on the type of activity you intend to carry out. Licences vary from one region to another and from one municipality to another, so it’s best to get professional help from a gestor in your region if this is the case.

Finally when all these steps are complete, you are ready to start working, earning money, paying your social security and taxes.

READ ALSO: Eight key lessons I've learnt about being self-employed in Spain

thelocal