What will be the profit margin of hotels in the 2025 season?

The tourism sector was trying to cope with increasing costs, exchange rate pressure and personnel employment problems within the framework of the macroeconomic policies being implemented. In addition, expectations, especially for the high season, were positive and cautious.

Data is very important in May and June. Since the main mass and tourism regions have a significant share in total tourism revenues, the number of guests coming to these destinations gives important messages about how the season will go.

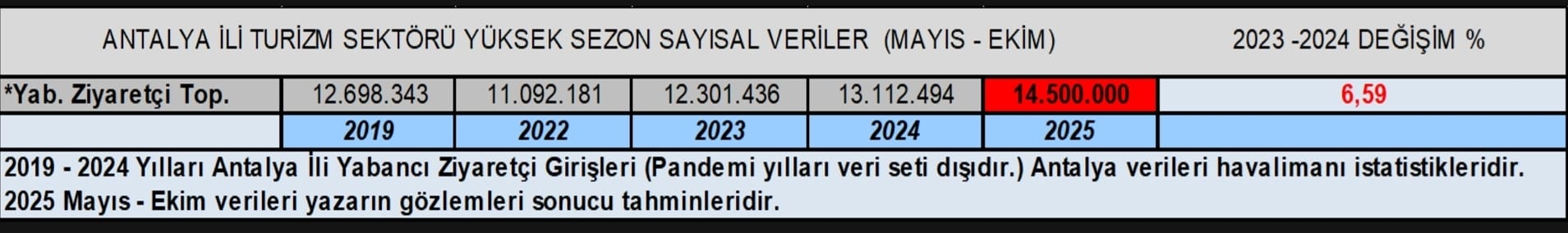

Especially Antalya province is a harbinger of important data with its income, bed capacity, employment and location in the Mediterranean basin. As can be seen in the attached table, May and June months have consisted of numerical figures and a parallel course to 2024 compared to previous years. This actually meant that the numerical data in the high season of 2025 would be parallel to expectations and there could be a high season growth of around ten percent.

I had predicted a growth of 10-13 percent in my thoughts and opinions regarding the high season in tourism. The statements made in the press and publications by commentators who do not have a general knowledge of the sector in 2005 are negatively affecting the sector. We cannot say that there is no problem. We have structural problems and we cannot ignore the fact that numerical values are approaching a certain saturation. We need to be ready for more rational growth. Turkish tourism will achieve a growth above global growth figures, but at this point it is difficult to see a growth figure 100 percent above the global growth figure as in previous years.

Turkish tourism is approaching numerical saturation, especially in summer destinations. Of course there will be growth, but it will be difficult to see consecutive 10 percent growth as in previous years. We can continue with a more rational growth but above global growth figures for many years.

The most important risk here is the rapidly increasing bed supply, especially in summer destination regions. It is time to prepare growth controls and regulations for bed supply. Our country, which has a very strong potential in product segmentation, no longer contributes to competitiveness in terms of service quality and employment opportunities. This is one of the most important structural problems. Turkey should not fall into the middle-low income trap as the main strategy in the summer holiday destination category.

One of the important parameters in the high season of 2025 is that the correlation between the costs and revenues of the sector, whose revenues are entirely in foreign currency, will cease to be manageable. This is one of the main parameters that challenges the sector the most. Summer holiday destinations in particular are priced with package tours. Therefore, since the price increases of more than 10 percent here are above average inflation, it is very difficult to convince the consumer to accept this increase. The concept of vacation will continue as a part of life and living, but Turkish tourism must also find strategic solutions to its structural problems.

The developments in the TL-Euro parity, especially in the last two months, although externally sourced, have provided some relief to both the tourism sector and the exporter. The devaluation of the Turkish Lira-Euro exchange rate compared to the same period of the previous year is around 28 percent. With figures of 47 in the sector and parity support in the upcoming period, a structure more in line with expectations may be formed in the high season.

Margins have particularly retreated in profits. While there was a margin of 35-45 percent in operational profits in some years depending on the characteristics of the facilities, the deterioration of the correlation between exchange rates and inflation due to the implemented monetary policy and macroeconomic policies has also significantly weakened operational profits. However, in the current conjuncture, the tourism accommodation sector has positively differentiated itself from the sectors in the domestic market. Cash flow and profitability continue. However, profit margins have narrowed. In this context, profit margins in facilities in 2025 will vary between 25 percent and 35 percent depending on the characteristics of the facility.

If we touch upon tourism credits; the total accommodation, or hotel sector credits are around 11.5 billion dollars. This share is around 4 percent of the total credit volume and is quite low. The tourism sector is the sector with the strongest asset structure that can convert borrowing into cash at a very low possible risk. The financial liabilities of a sector with an annual revenue target of 65 billion dollars are approximately one-sixth of the value it creates. When viewed from this perspective, it is clear that the tourism sector has taken on an extraordinarily resilient and sustainable structure. However, structural problems should not be ignored. The tourism sector is still attracting investment. It is a sector that is on the radar of both international and domestic investors. It has significant potential among future sectors.

turizmekonomi