The treasury is tight in September and October, but will breathe in November.

SEBNEM TURHAN

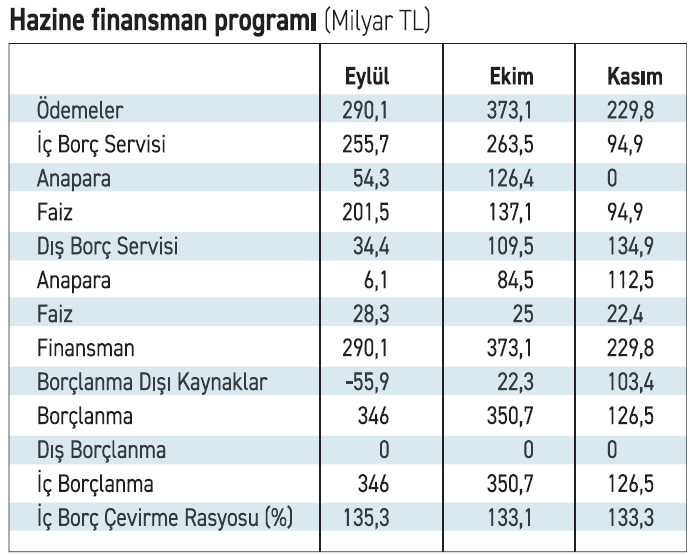

The Ministry of Treasury and Finance kicked off its September borrowing calendar yesterday with two issuances. The most notable of these issuances was the direct sale of lease certificates indexed to TLREFK, marking the first time in history that a bond sale complied with Treasury participation principles was conducted. Meanwhile, the Treasury's debt payment schedule for September and October is quite tight. With 255.7 billion lira to be paid on domestic debt this month and 263.5 billion lira in October, the Treasury will be relieved by a 94.9 billion lira redemption in November.

According to its borrowing strategy, the Treasury plans to issue 346 billion lira this month. This translates to a net borrowing of 90 billion lira, given its 255.7 billion lira domestic debt service. 25 billion lira of the borrowing will be provided through direct sales, and 47 billion lira will be provided through sales to public institutions. In September, the Treasury will issue 9-month bonds, reissue 2- and 5-year fixed-rate bonds, and initial issuances of 5-year CPI-indexed bonds and 10-year fixed-rate bonds. Yesterday's 2-year TLREFK-indexed sukuk was sold directly.

The Treasury's heavy borrowing schedule coincides with the Central Bank's Monetary Policy Committee meeting, scheduled for this Thursday. Meanwhile, political tensions continue to rise. Experts warn that rising political tensions could put short-term returns under pressure, as investors demand additional premiums. They emphasized that the good news is that issuance pressure has eased significantly since September.

The Treasury's heavy borrowing schedule coincides with the Central Bank's Monetary Policy Committee meeting, scheduled for this Thursday. Meanwhile, political tensions continue to rise. Experts warn that rising political tensions could put short-term returns under pressure, as investors demand additional premiums. They emphasized that the good news is that issuance pressure has eased significantly since September.

According to the borrowing calendar, there will be a 263.5 billion lira redemption in October, while borrowing is set at 350.7 billion lira. Net borrowing will amount to 87 billion lira. Debt payments will drop to 94.9 billion lira in November. In contrast, the planned issuance for November was 126.5 billion lira, leaving only 31 billion lira in net borrowing. According to the expert, the Treasury will reassess its financing needs by the end of the year, based on budget implementation and foreign exchange reserve dynamics. Experts indicated that the Treasury will wait until mid-September for foreign bond issuance, emphasizing that the course of political tensions will be crucial.

According to a report prepared by Gedik Investment Research Specialist Burak Pırlanta, the Treasury's projected debt rollover ratio for the current quarter is 135%. The Treasury will repay 615 billion Turkish Lira in domestic debt between September and November, comprising 181 billion Turkish Lira in principal and 434 billion Turkish Lira in interest . The Turkish Lira equivalent of foreign debt repayments is projected to be approximately 279 billion Turkish Lira.

The report noted that the Treasury planned to borrow over 823 billion Turkish Lira in total domestically, corresponding to a domestic debt rollover ratio of approximately 134 percent. According to these figures, the Treasury's net domestic borrowing (new bond issuance) for this period is projected to be 643 billion Turkish Lira. The re-borrowing rate for the January-August period was 136.5 percent.

TLREFK tender yields 80 billion lira in salesMeanwhile, net sales in the nine-month Treasury bill auction held yesterday by the Ministry of Treasury and Finance reached 25.95 billion Turkish Lira. Nominal bids were received for the auction, while nominal sales were set at 33.72 billion Turkish Lira. The average simple interest rate in the auction was 38.88 percent, and the average compound interest rate was 40.51 percent. In the Treasury's first auction of September, the minimum price was 76,587 Turkish Lira, and the average price was 76,978 Turkish Lira. Prior to the auction, the Treasury sold 10 billion Turkish Lira to market makers through non-competitive bids and 31.1 billion Turkish Lira to the public, thus borrowing 67.05 billion Turkish Lira. In the TLREFK-indexed auction, which complied with participation principles, sales reached 80 billion 074.4 million Turkish Lira.

■ Domestic debt rollover ratio rose to 141 percent in AugustPırlanta noted that in the first eight months of the year, the Treasury borrowed approximately 2.5 trillion Turkish Lira in response to approximately 1.8 trillion Turkish Lira in domestic debt repayments. He noted that the domestic debt rollover ratio, which averaged 135.5 percent between January and July, rose to 141 percent in August with borrowing exceeding the domestic debt service. According to Pırlanta's report, the Treasury's debt repayment projections announced for the end of July 2026 project a domestic debt repayment of over 3.5 trillion Turkish Lira between August 2025 and July 2026. Pırlanta noted that this amount could be exceeded when short-term bond issuances are taken into account. He wrote, “The projected external debt repayment for this period exceeds $21 billion, indicating that a portion of domestic borrowing will need to be transferred to external debt repayments. Taking into account the cash-based primary deficit we project for this period, we believe the Treasury's domestic borrowing needs could approach or even exceed 4.0 trillion Turkish Lira by the end of July 2026. This corresponds to an average monthly amount of 350-360 billion Turkish Lira. Accordingly, the domestic debt rollover ratio could exceed 130%.”

ekonomim