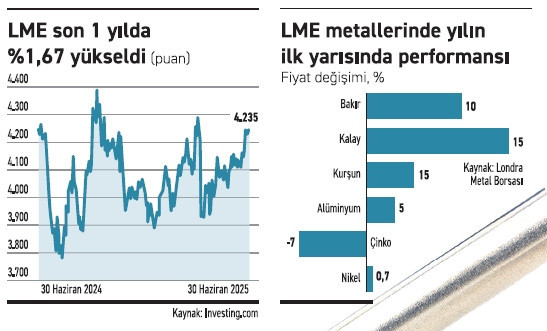

In the first half, tin shone, zinc remained behind!

EVOLUTION IS SMALL

Prices of basic metals traded on the London Metal Exchange (LME) generally completed the first half of this year with limited increases. While supply cuts, trade policies and the weak dollar affected prices in the first six months of the year, expectations for the second half are shaped more around excess supply, geopolitical tension and demand imbalances.

COPPER

In London, it gained about 10 percent in the first half of the year and displayed a cautious outlook. The LME-CME price difference caused by US import duties caused physical copper stocks in Europe to flow to the US. This situation supported LME copper prices upwards. As of June 30, the price of copper per ton rose to $10,040.

ALUMINUM

It has been stable. Prices increased by 3 percent in the first half of the year due to the balance of demand in the US and China, production limits and increasing logistics costs. China's limitation of production capacity to 45 million tons and energy-related production cuts in the West were among the main factors supporting prices. The price of aluminum per ton was approximately $2,573 as of the end of June.

ZINC

fell by around 7 percent in the first half of the year. The LME price of zinc is $2,764 as of June 30. It may come under pressure in the future due to increasing refined supply.

NICKEL

It was one of the weakest performing metals in the first half of the year, with Indonesia's high production and high global inventories weighing on prices.

Nickel, which fell to $ 13,800 in April, was traded at $15,020 at the end of June. A horizontal trend was observed compared to the beginning of the year.

TIN

The metal that has been the most volatile and the strongest of the year has emerged. The price, which exceeded $38,000 in April due to supply disruptions in Myanmar and Congo, fell to $33,845 as we entered the summer months. The gain in the first 6 months of the year was around 15 percent. If supply-side uncertainties continue, tin's high volatility is expected to continue in the second half.

LEAD

gained value, albeit limited, thanks to the lively demand in the battery sector. The activity in the automotive sector, especially as we enter the summer months, supported the prices. The lead price was at $2,025 at the end of June. The increase since the beginning of the year is around 5 percent.

Supply risks and weak dollar will determine direction for metalsIn general terms, the main factors that will determine the direction of metals traded on the LME in the second half of 2025 include global production trends, the course of the dollar, geopolitical developments and the level of industrial demand.

In copper and aluminum in particular, production cuts in the West and capacity limitations in China are supporting prices. In tin, geopolitical tensions in Myanmar and Africa are hitting production, threatening supply chains. In lead and zinc, increasing mining production risks creating a surplus. In nickel, the Indonesian-based production boom stands out as the main reason for the downward pressure on prices.

Trade tensions could affect demand On the other hand, the economic downturn caused by trade tensions could put additional pressure on metals, especially those with widespread industrial use such as copper and aluminum.

The weakness in the dollar resulting from the US financial problems will be a factor that provides support for metals.

Green energy transition, electric vehicle production and infrastructure projects continue to be supportive in the medium term, especially for copper, aluminum and nickel.

ekonomim