New Medium Term Program announced: Privatization revenues expected to increase approximately ninefold next year

Vice President Cevdet Yılmaz announced the details of the Medium-Term Program, covering the 2026-2028 period. The program aims to reduce inflation to 8 percent, boost the economy to $1.9 trillion, and reduce unemployment. Privatization revenues are also expected to increase approximately ninefold next year.

Vice President Cevdet Yılmaz presented the Medium-Term Program (MTP) covering the 2026-2028 period at Beştepe. The program, published in the Official Gazette and entered into force, outlines the goals of the Turkish economy for the next three years.

Yılmaz stated that the preparation process was based on shared wisdom and a participatory approach, and that the program was developed in consultation with all relevant parties. He stated that the fundamental macroeconomic policy approach was maintained despite the negative developments experienced at the global and regional levels since September last year.

As part of the fight against inflation, which is the main focus of the program, it was announced that inflation, which stood at 44.4 percent in 2024, will be gradually reduced. The target is for it to fall to 28.5 percent in 2025, 16 percent in 2026, 9 percent in 2027, and 8 percent in 2028.

Yılmaz stated that a period of uninterrupted disinflation began in June 2024, with the inflation rate declining by a total of 42.5 percentage points during this period. He added that they expect the disinflation process to continue given the improvement in inflation expectations and key trend indicators.

Yılmaz explained that price stability policies will be implemented along three main axes, focusing on maintaining macroeconomic policy coordination, supporting supply-side policies, and ensuring that managed prices are consistent with targets.

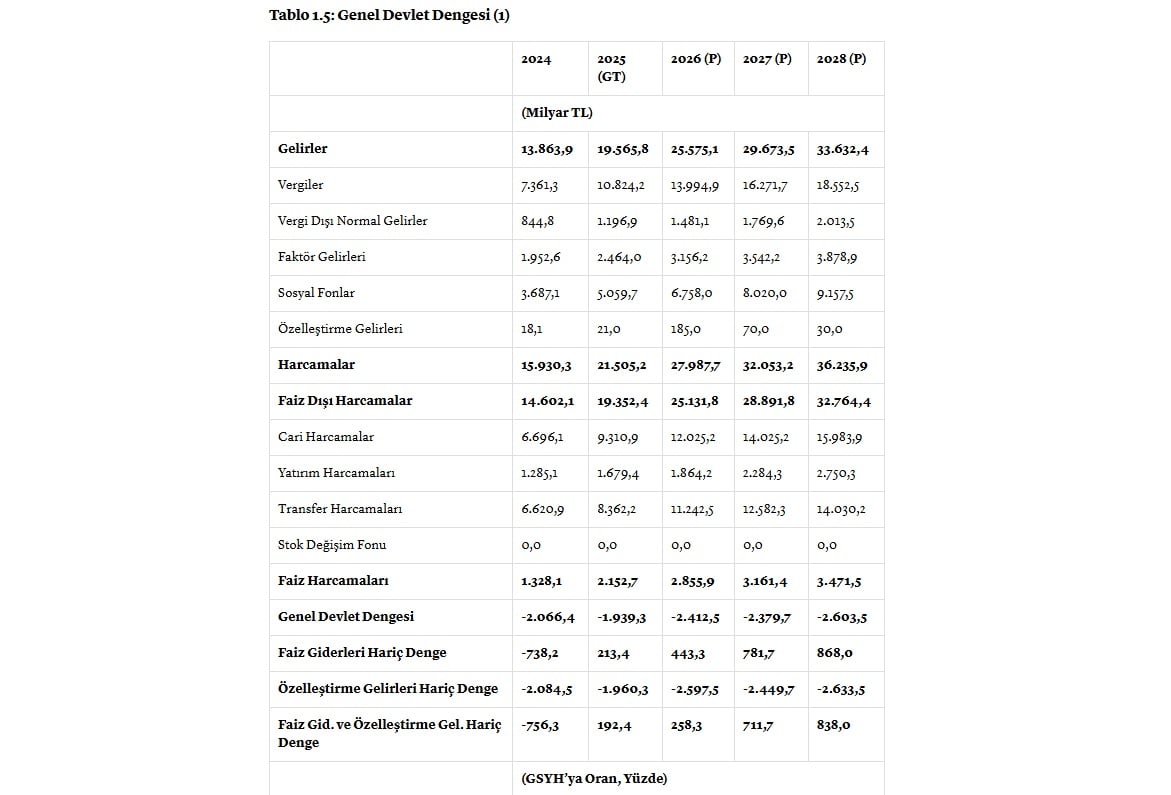

According to the new Medium Term Program (OVP), a significant increase in privatization revenues is expected. Privatization revenues, which were $21 billion in 2025, are expected to rise to $185 billion in 2026.

Growth, which reached 3.3 percent in 2024, is projected to remain at the same level in 2025. It was stated that growth will gradually strengthen as the disinflation process progresses and structural transformations are implemented.

Growth is targeted to reach 3.8 percent in 2026, 4.3 percent in 2027, and 5 percent in 2028. During the program period, the economy is expected to exhibit moderate and balanced growth performance, in line with the disinflation process.

The unemployment rate, which is expected to be 8.7 percent by 2024, is planned to be gradually reduced. It is projected to fall to 8.5 percent in 2025, 8.4 percent in 2026, and 8.2 percent in 2027.

The unemployment rate is targeted to fall below 8 percent by 2028. The goal is to create approximately 2.5 million additional jobs in the economy during this four-year period.

It was announced that employment policies will be shaped around four main priorities: expanding secure flexible working models, increasing labor force participation rates, strengthening skills matching, and directing idle labor into productive employment.

It was stated that by the end of 2025, Türkiye will have a national income exceeding $1.5 trillion for the first time, with a per capita income exceeding $17,000. This will put Türkiye among the high-income countries according to the World Bank's classification.

By 2028, national income is projected to approach $1.9 trillion, with per capita income rising to $21,000. Exports are projected to exceed $300 billion, and tourism revenue is projected to reach $75 billion.

It was announced that gross reserves had increased by approximately $80 billion over the last two years, reaching $178.4 billion as of the end of August. It was also noted that the risk premium had fallen from levels around 700 to below 270.

It was announced that the current account deficit narrowed to $20.2 billion in June 2024, falling to 1.7 percent of national income. It was also stated that the current account deficit, which had narrowed to $18.9 billion as of June 2025, had fallen to 1.3 percent of national income.

The current account deficit to national income ratio is targeted to decline to 1.3 percent and 1.2 percent in 2026 and 2027, respectively. This ratio is projected to drop to 1 percent in 2028.

It was announced that the budget deficit-to-national income ratio is projected to be 3.6 percent in 2025, 3.5 percent in 2026, and below 3 percent at the end of the period. It was stated that as temporary earthquake spending decreases, the budget deficit will decrease and become compatible with the EU Maastricht criteria.

It was stated that the aim was to achieve rapid financial consolidation and that the fiscal stance would be tightened while meeting ongoing needs in the post-disaster period.

It was announced that industrial transformation will be accelerated based on high value-added, technology-intensive production. It was stated that the R&D and innovation ecosystem will be strengthened, and private sector investments in strategic areas such as artificial intelligence, semiconductors, the defense industry, biotechnology, and space technologies will be supported.

It was stated that by accelerating digital transformation, the competitiveness of SMEs in particular will be increased, and the integration of advanced technologies such as 5G, artificial intelligence and the Internet of Things into production processes will be ensured.

It was announced that the quality of vocational and technical education will be increased within the scope of strengthening human capital and the young population will be directed towards employment in critical technology fields.

The government has considered selling bridge and highway rights. According to Bloomberg , the Privatization Administration has sent a request for proposals for the bridges and highways to investment banks. The plan is still in its early stages, and it's unclear whether a final agreement will be reached.

In a previous tender held in 2012, the operating rights of approximately 2,000 kilometers of roads and bridges were sold for $5.7 billion, but then-Prime Minister Recep Tayyip Erdoğan found this price “too low” and cancelled the tender.

At the time, Erdoğan said that a sale for less than $7 billion would be a "betrayal."

The bridges, through which hundreds of thousands of vehicles pass every day, not only connect the European and Asian sides of Istanbul but also play a critical role in the strategic Bosphorus route between the Black Sea and the Mediterranean.

The bridges and highways are currently operated by the General Directorate of Highways (KGM). The government aims to use the proceeds from the potential sale to address the budget deficit.

Medyascope