Dark clouds over Polish photovoltaics. Experts sound the alarm

- The Institute of Renewable Energy (IEO) has just published its latest report "Photovoltaic Market 2025".

- - Despite the decline in dynamics in 2023-2024, the photovoltaic (PV) sector in Poland is developing at a pace similar to mature markets such as Germany or Spain - experts emphasize.

- Poland also stands out with a high rate of PV capacity installed per capita at the end of 2024 - better than in the USA or China.

- - However, further development of photovoltaics in Poland requires investments, systemic and legislative changes - says Grzegorz Wiśniewski, president of the Institute of Renewable Energy.

- - Market regulations in Poland still favor centralized energy generation, offering high revenues for the most expensive conventional sources - adds the head of IEO.

- At the end of the first quarter of 2025, Poland had reached 21.8 GW of installed capacity in photovoltaics (PV), of which 59% were micro-installations and 41% PV farms and small installations. The market has undergone a significant transformation - the dominant role was taken over by large PV farms above 1 MW , which accounted for half of the new capacity - I read in the latest report of the Institute of Renewable Energy (IEO) entitled "Photovoltaics Market 2025".

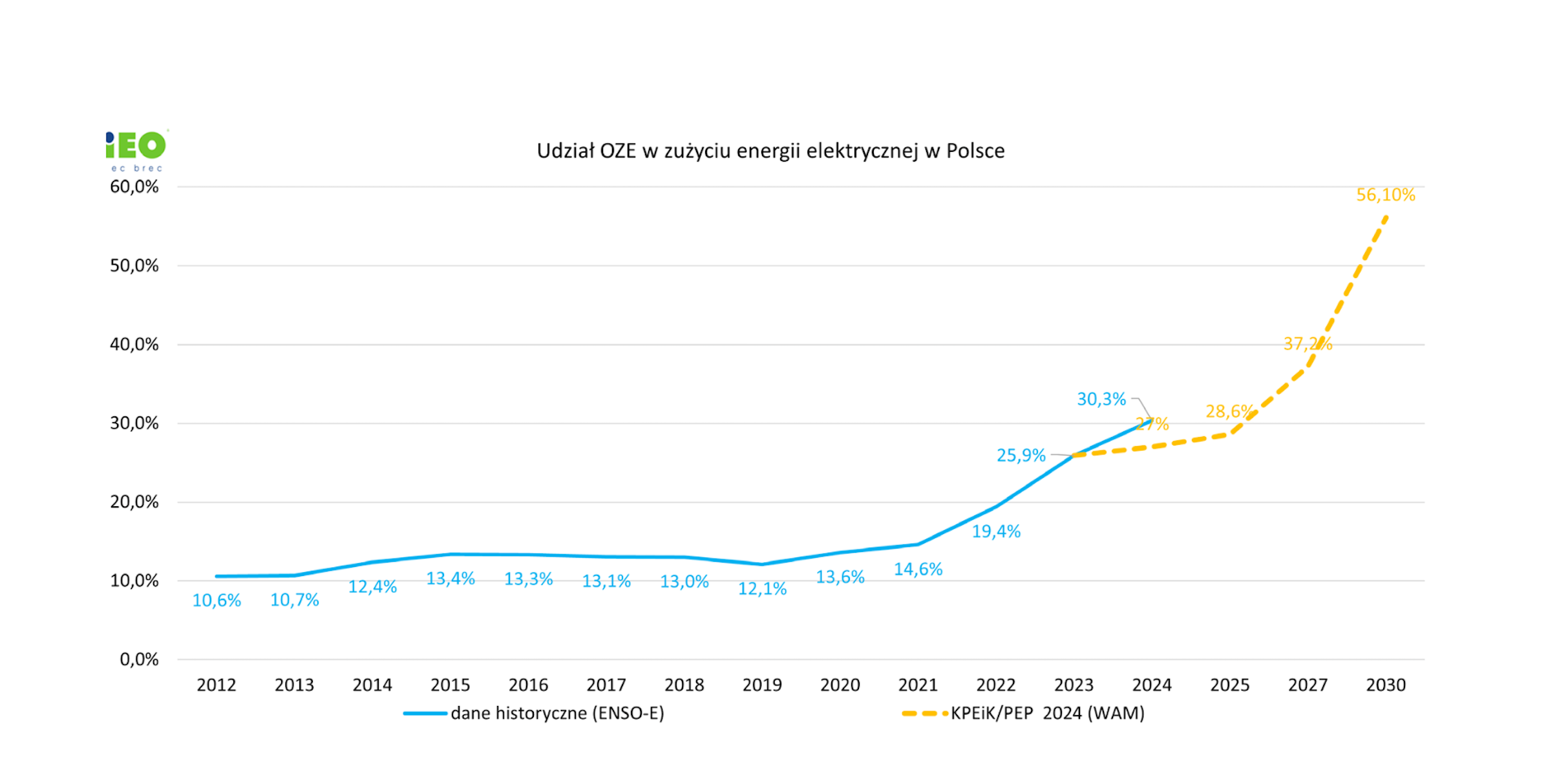

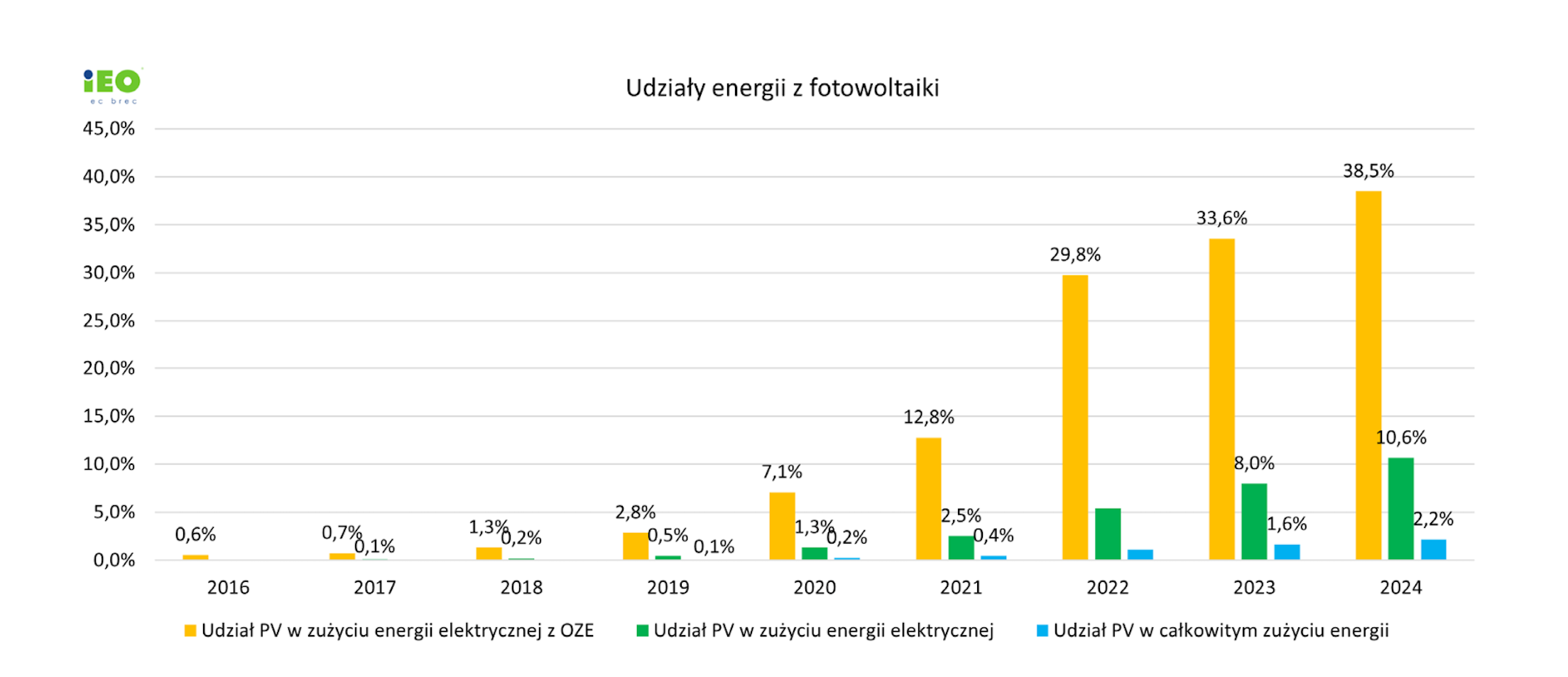

Photovoltaics accounted for 64% of renewable energy capacity in Poland, and its share in electricity production from renewable energy increased to 31.5%.

Poland still remains at the forefront of the EU in terms of PV capacity growth - in 2024 it took 5th place with an increase of 3.7 GW. Globally it was ranked 11th. Despite the decline in dynamics in 2023-2024, the PV sector in Poland is developing at a pace similar to mature markets such as Germany or Spain.

Industry forecasts indicate reaching up to 38 GW of PV capacity by 2028, and government forecasts (KPEiK) indicate the possibility of reaching 38 GW of capacity in the system in 2035. Poland also stands out with a high rate of PV capacity installed per capita at the end of 2024 - better than in the USA or China

- experts say.

In 2024, 141.5 thousand new micro-installations with a capacity of 1.43 GW were connected to the grid. The "Mój Prąd" program supported 53.5 thousand installations, including 9746 electricity storage facilities and 3957 heat storage facilities. The average power of micro-installations increased and amounted to 10.3 kW.

The authors of the report indicate that the net-metering prosumer settlement system still dominates, but in the total number of prosumers in Poland - 1.53 million (total capacity of micro-installations is 12.6 GW) - the importance of net-billing is growing .

It was noticed that the promoted new solutions (e.g. collective and virtual prosumer, energy clusters and cooperatives) do not operate in this segment and there is a lack of market-oriented solutions.

- PV farms above 1 MW have become the main driver of photovoltaic growth - 2.4 GW of large farms were added in 2024. New RtB and greenfield projects are developing dynamically, although the number of building permits is falling. Renewable energy auctions in the auction basket dedicated to PV and wind farms in 2024 contracted 16 TWh of energy from weather-dependent sources in fifteen-year contracts, of which 99% is to come from PV - experts say.

There is a renewed interest in the auction system , which offers competitive revenue parameters compared to the sale of PV energy on the market or within PPAs burdened with the cost of the PV profile. The main barriers to the development of farms are problems with connections to the grid and curtailments (limitation of electricity production from RES - ed.)

- the authors of the report point out.

The share of battery storage in hybrids with PV farms is still lowThey add that wind-solar hybrids with energy storage offer greater stability and efficiency than PV farms. Battery storage (BESS) is becoming key for system balancing and price arbitrage. In capacity market auctions until 2029, 4.3 GW of BESS capacity has been contracted within the capacity market.

The share of battery storage in hybrids with PV farms is still low. Alternative connection methods, such as cable pooling and direct lines, are gaining importance, although they require legislative changes.

PV installation costs are falling with the increase in installation power - in 2024, micro-installations cost an average of PLN 4,069/kW, and PV farms around PLN 2,425/kW. Bifacial modules dominate, and the most frequently chosen are the large ones with a power of 500 Wp. Hybrid inverters and energy storage are gaining popularity.

Companies planning to expand indicate risks related to the lack of available connection capacity, low and negative energy prices , non-market generation constraints and unclear regulations.

The solution with the greatest potential is the rapid, green electrification of heating and industry.As the authors of the analysis emphasize, the most serious problem, after the previously noticed limitations of the operation of PV sources, are low energy prices for the PV generation profile.

In particular, this phenomenon was observed only in 2024, with the consolidation of the downward trend in average energy prices (after the 2022 energy crisis) along with the rapid growth of PV capacity in 2021-2023 and the oversupply of energy during PV generation peaks.

- we read in the report.

In a situation of growing surpluses and low prices of PV energy, the solution with the greatest potential is the rapid, green electrification of heating and industry, as the cheapest way to utilize surplus energy from PV sources and the most advantageous solution for reducing heat prices and decarbonizing heating.

Electric boilers coupled with daily and seasonal heat storage tanks (PTES, BTES) can capture summer surplus electricity from PV and use it in the form of heat during periods outside PV generation, including the winter heating season.

Poland and the EU are working to increase the share of renewable energy and electrify the entire economy, which is expected to result in lower heat prices, improved competitiveness and greater energy independence. The EU is supporting the recovery of the PV industry through the NZIA regulation, which introduces non-price criteria in auctions and promotes the production of PV components in Europe.

- The year 2024 was a breakthrough for Polish photovoltaics, but also full of challenges. On the one hand, an impressive level of 21.8 GW of installed capacity was achieved, making photovoltaics the dominant source of renewable energy in Poland. On the other hand, the market is entering a phase of maturity, in which further development requires not only investments, but above all systemic and legislative changes - comments Grzegorz Wiśniewski, president of the Institute for Renewable Energy (IEO).

He points out that current market regulations in Poland still favour centralised energy generation, offering high revenues for the most expensive conventional sources and financing in distribution tariffs huge outlays for grid connections and so-called contracts for difference for large nuclear sources and offshore wind farms.

Support for distributed generation, including prosumer photovoltaics, is marginal and often limited to anecdotal solutions such as energy clusters, energy cooperatives or virtual prosumers

- emphasizes Grzegorz Wisniewski.

It is worth introducing full dynamic tariffs, including distribution tariffs, more widelyHe points out that for new investors in the PV industry, including new prosumers, the challenge remains the net-metering settlement system used by a million "old" prosumers who do not respond to price signals coming from the energy market and the reported balancing problems of the National Power System.

- Support programs such as "Mój Prąd" should focus on supporting energy efficiency, increasing self-consumption, demand management and electrification of heating and transport, and not on increasing the capacity of existing sources - believes the president of IEO.

It indicates that a broader introduction of full dynamic tariffs (including distribution tariffs) would help change the current energy demand profile and would allow for a further increase in the share of PV in the Polish energy mix .

Distribution system operators refuse to issue connection conditions- This year's report has a significant subtitle "Photovoltaics in the electricity and heat market" in order to indicate the urgent need to combine the development of the PV and heating sectors as a flexible recipient of solar energy - emphasizes Grzegorz Wiśniewski.

Although the market has not experienced a slowdown, which was partly expected a year ago when the previous IEO report was released, President Wiśniewski's calm is disturbed by approaching clouds - which in the case of solar energy is not just a metaphor.

The problem is access to the power grid - distribution system operators refuse to issue connection conditions. - Analysis of the structure of grid connection refusals clearly shows that it was PV technology that was most often rejected by grid operators - remind the authors of the IEO report.

portalsamorzadowy