Why European stock markets are still doing well despite Trump

While the stock markets in the United States are mainly in the red this year, European shares are doing better. According to RTL Z stock market analyst Jacob Schoenmaker, the trade war unleashed by Donald Trump is causing a 'renaissance' in Europe. According to Schoenmaker and stock market expert Stan Westerterp, Trump's actions are not the only explanation.

If you take a tour of the major European stock exchanges, you will see green numbers almost everywhere. While the Dutch AEX index is doing only slightly better at the time of writing, the German DAX index is doing much better. In addition, the French CAC 40 and the British FTSE 100 are also not performing badly this year. And that also applies to the STOXX Europe 600, a stock index of the largest European companies.

Catching up"America has been pulling the cart for years, while Europe lagged behind," Westerterp begins his explanation of the European advance. "Now the pain is being felt in America, which is making European shares more popular again," according to the asset manager.

In other words, according to Westerterp, it comes down to the fact that American shares have performed much better than European ones in recent years and that the roles have now been reversed. "Europe is catching up," Schoenmaker said last week.

Investors estimate that mainly American companies are the ones who are suffering because of the trade war, according to Schoenmaker. "But that is one side of the story. Certain American companies were also very expensive in recent years. Priced for perfection, as they say." This means that the price of a share is worth more than is considered reasonable by experts.

This overvaluation means that it was 'expected' that American shares would collapse at some point, according to Westerterp. The trade war has accelerated everything. And the European stock markets are benefiting from that, because the shares of companies here were relatively cheap.

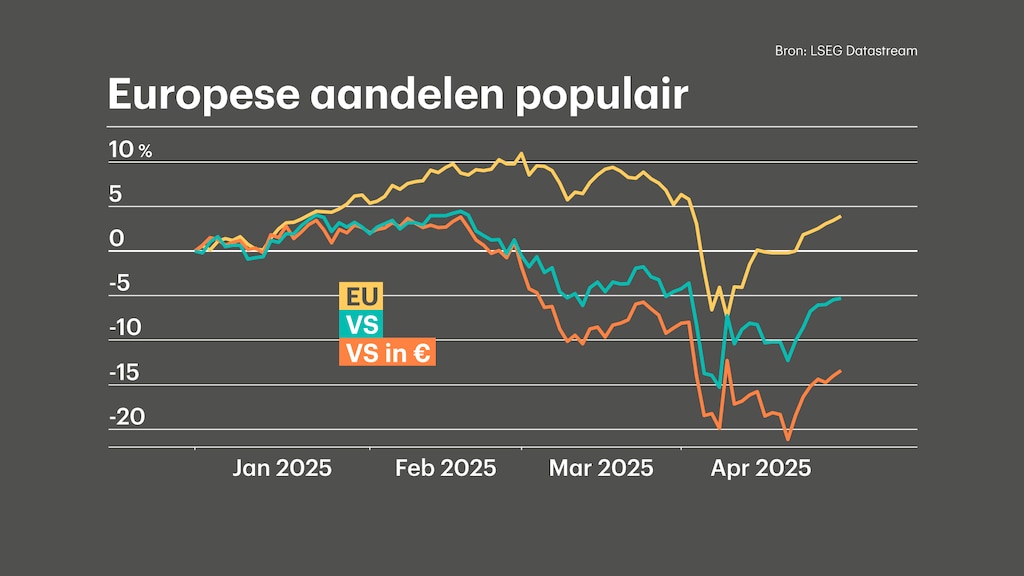

Below you will find an overview of the performance of the 600 largest European companies this year (yellow), the price of the American S&P 500 in dollars (blue) and the same price in euros (orange). This graph was made on May 1st.

Trump's antics regarding import duties were also visible on the stock markets here in Europe. However, the stock markets bounced back quite quickly.

This does not mean that European investors necessarily benefit from the recovery, on the contrary. Many Europeans, including the Dutch, invest in American shares.

'Dollar effect'According to the gentlemen, the dollar effect is also added to this. The decline in the value of the dollar ensures that the losses are even greater.

If we look more closely at the companies behind the shares, according to Westerterp, we can see that the blows in America are mainly with the so-called high beta shares. The price of these companies goes up and down more violently than that of other companies. These are, for example, tech giants such as Apple and Amazon or chipmaker Nvidia.

European stocks with higher volatility, another word for the degree of mobility of stocks, also generally perform less during this period. For example, Dutch chipmaker ASML and Ozempic manufacturer Novo Nordisk (one of Europe's most valuable companies) score less.

'Boring is doing well now'The 'traditional' and 'boring' companies are generally doing well here now, says Westerterp. "You see that these types of companies, such as insurers and telecom companies, are also relatively spared from the blows in America."

Still, he says tech stocks are good investments for the long term. "It's a relative game. They've been very profitable over the last few years and will be very profitable over the next 10 years."

Eye on the futureIn addition, he believes it is useful for investors to keep an eye on the US, with an eye to the future. "There are large companies there with unique business models that have no European counterpart."

History has shown that investors are not only concerned with the future. This is of course also because the future cannot be predicted. For example, 2025 shows how unpredictable the stock markets are. Or as Schoenmaker says: "It is an eventful year."

The unrest on the stock market has brought back a lot of stock market clichés. Here are the five biggest:

RTL Nieuws