The government faces a new problem: why are services rising more than goods and what impact does this have on consumption?

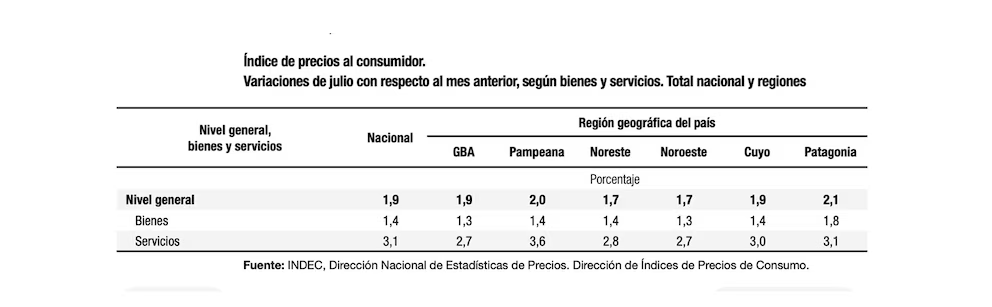

The latest inflation data confirmed a trend that has been going on for several months: service prices continue to rise faster than those of goods . According to INDEC (National Institute of Statistics and Census), services increased 3.1% in July, while goods increased by just 1.4% . This phenomenon, which has persisted since the beginning of 2024, is generating changes in consumption and complicating the government's deflation plans.

Economist Lorenzo Sigaut Gravina (Equilibra) identified the exchange rate jump in February of this year as a turning point . Since then, services have grown "systematically above the general level," driven by increases in public tariffs, but also by increases in private services such as healthcare, education, and rentals.

One of the key factors, according to analysts, is the difference between "tradable" and "non-tradable" sectors . While goods compete with imported products and are subject to the exchange rate—which the government keeps fixed— services operate in more closed markets, with little competition.

“ In services, there's no competitive pressure, so costs are more easily passed on to prices ,” Sigaut Gravina explained. Added to this is the impact of trade liberalization, lower tariffs, and strong global supply—especially from China—which has helped contain commodity prices.

Gabriel Caamaño , of Outlier, also highlighted that goods "fall faster" because they are more tied to the dollar and monetary policy. " With a currency anchor, tradable goods adjust sooner. Services, having a higher proportion of labor costs, take longer to correct ."

Another key factor is the impact of wages. Services—which are labor-intensive—tend to follow the recovery of real incomes, which introduces more inertia into their evolution. Therefore, according to Caamaño, service prices "respond more slowly" to both increases and decreases.

Fausto Spotorno (Ferreres & Asociados) recalled that during Alberto Fernández's administration, many service prices were frozen or capped. " Healthcare, education, rent: they were all behind. Now they're being corrected, and that's leading to steeper increases ."

At the same time, the analyst warned that there is still room for further adjustments in public services, especially in electricity, water, and transportation. "Services will continue to rise until rates are finally harmonized."

Despite the lag, most economists agree that this trend will not last forever. Sigaut Gravina indicated that if the recession deepens or domestic demand weakens, the scope for further price increases will be smaller. " If goods start to rise due to costs, services should fall in line. The gap can be narrowed ."

Analytica's Ricardo Delgado was more specific: he projected that convergence could begin before the end of the year. " It was expected that services would run faster at this stage. But as relative prices readjust, the pace should even out ."

The key, according to Delgado, will be how demand, income policy, and the exchange rate evolve. If the government manages to maintain the monetary anchor and stabilize domestic costs, services inflation could begin to slow by 2026.

elintransigente