Major technology companies choose Spain as the benchmark in southern Europe for data centers.

The team led by Frenchman Elliot Zounon, head of data centers at the real estate consultancy CBRE, has recently prepared a report in which it has identified the Iberian Peninsula, and specifically Spain , as the only place where, for the first time, all the major technology companies, known as hyperscalers in the sector's jargon, have announced that they are betting on a single location.

“For the first time in history, all hyperscalers have officially deployed their cloud regions together in a single location, which is already driving long-term demand for computing power,” the report states.

“Over the past five years, the Spanish data center market has proven to be a key pillar in the European and global digital infrastructure network,” Zounon tells CincoDías: “There isn't a single investor, operator, or major technology company that doesn't have establishing a data center project in the Iberian market as part of its strategic plans.”

In this document, CBRE includes the successive opening announcements from industry leaders such as Amazon Web Services (in Aragon); Microsoft, Google, Oracle, IBM, Kyndryl, and OVHcloud in Madrid; Meta in Talavera de la Reina (Toledo); and De-Cix in Sines (Portugal).

The arrival of these hyperscalers in Spain, driven by the activity of artificial intelligence and cloud services, has prompted major operators, the hyperscalers themselves, and real estate companies to build the data centers necessary to support the growing demand from businesses and users.

The Spanish real estate company Merlin Properties stands out among them all. It plans to have 600 MW (megawatts of computing capacity) by 2029 at its centers in Getafe (Madrid), Álava, and Barcelona, which are already operational in the initial phase , in addition to the one it plans to begin construction in Lisbon this year, according to its public plans. Beyond that date, it seeks to multiply that capacity with two more megacenters in Extremadura.

This company builds infrastructure without using water for cooling as an advantage - due to water shortages that can jeopardize other projects - and already has well-known clients in the sector such as Meta (parent company of Whatsapp, Instagram and Facebook) and Coreweave (artificial intelligence giant). In this case, the REIT (publicly traded real estate investment company), led by CEO Ismael Clemente, has partnered with the technology company Edged to design these data centers .

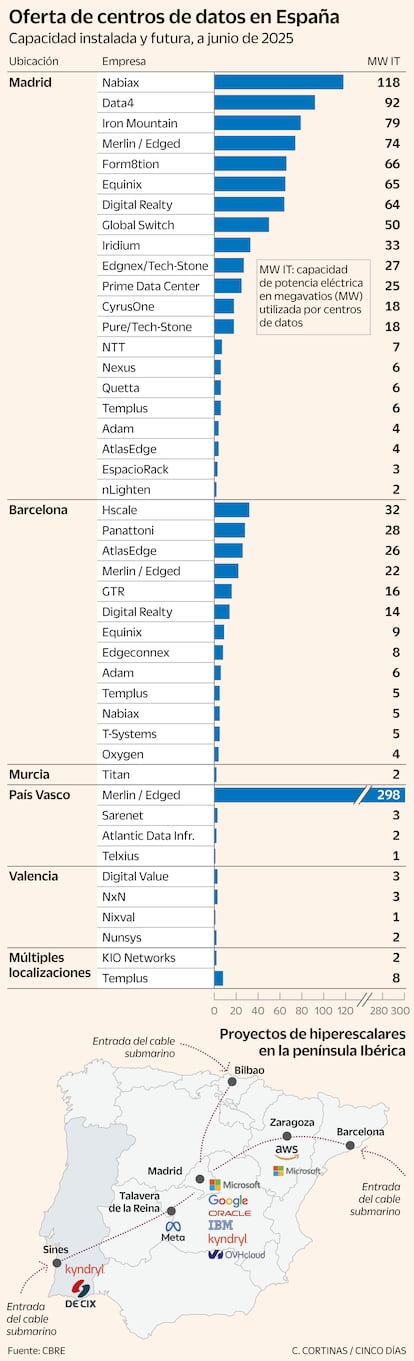

Along with Merlin, CBRE compiles the names of other major players currently building these infrastructures (although it doesn't specify how many MW they have in operation and how many are announced for the future). Prominent names include Nabiax, Data4, Iron Mountain , Form8tion, Equinix, Digital Realty, Hscale, and Panattoni, among others. Other major players in the sector have also announced their entry, such as Azora (through its subsidiaries Tillion and Quetta) and Blackstone, which announced a €7.5 billion investment in an initiative in Aragon .

One of the reasons why major technology companies have invested in the peninsula is the submarine fiber optic cables that connect Spain and Portugal to numerous other points. These cables include 2 Africa by Meta, Orange, and Vodafone; Equiano by Google; EIG by AT&T and Verizon; Nuvem by Google; EllaLink by Telefónica; Orán-Valencia by Telefónica; Medusa by Afr-Ix; Medloop by Sipartech; Anjana by Meta; Grace Hopper by Google; and Marea by Meta and Microsoft, among other connectivity infrastructures.

Zounon, the head of CBRE, also points out that the national market has solid structural fundamentals for the development of projects of this importance, such as a stable and dynamic investment environment that justifies the capital investment, "and, above all, a strategic mix of renewable energy generation that allows us to meet the sustainability goals for the 2030 agenda." He also asserts that highly qualified talent is available.

FLAP-DublinIn recent years, Spain has become a significant European player in data centers, with 143 data centers, behind Germany, the United Kingdom, France, the Netherlands, Russia, Italy, and Poland. Traditionally, this market in Europe has been dominated by four cities known as FLAP (Frankfurt, London, Amsterdam, and Paris), recently joined by Dublin with a capacity of 328 MW. It is striking how Madrid has positioned itself at the top of the chasing pack, the so-called TIER-2, with 203 MW installed in the Spanish capital, followed by Milan, Zurich, Berlin, and Oslo. Barcelona occupies tenth place in this CBRE ranking of TIER-2 cities with 42 MW.

"The Iberian Peninsula is the best alternative to FLAP-D markets, offering new hubs with available land, energy, and connectivity, without the regulatory and congestion issues faced by other European cities," Zounon asserts.

In Madrid alone, that capacity is expected to reach 222 MW by 2026, and CBRE has compiled project announcements (largely dependent on grid power) for another 554 MW over the coming years.

Growing marketThe rise of data centers , which is highly dependent on the electricity consumption capacity that Red Eléctrica grants to potential projects in its five-year plans, is driven worldwide by the use of the cloud ( cloud computing ) and the strong growth of artificial intelligence (AI) in all types of developments such as machine learning , autonomous sensors, generative AI and robotics.

There are many examples of how data is used by users and businesses, from social networks like TikTok and Instagram; streaming platforms like Netflix, Spotify, and HBO Max; smart vehicles like Tesla; and tools like Office, Salesforce, and GPT Chat. Data from the CBRE study indicates that the creation of data storage will increase 90-fold between 2010 and 2025, a year in which global capacity will reach 181 zettabytes (each zettabyte is equivalent to 1 billion terabytes ). From 2022 alone, in three years, this capacity will have practically multiplied, primarily due to cloud computing and AI.

On an economic level, CBRE estimates that cloud services and AI will generate 13% annual growth in their respective markets, doubling their combined size to just over $2 trillion globally by 2030.

EL PAÍS