Construction recorded a new monthly decline in July: a distant improvement is forecast.

Construction is back in negative territory, with its activity level falling 1.8% monthly in July after rising in June. Within this context, nearly 90% of companies do not expect any significant improvement in the coming months.

The data comes from the synthetic indicator of construction activity (ISAC), prepared by the National Institute of Statistics and Census ( INDEC ). This once again reflected the sector's difficulty in consolidating a path of recovery and growth , with the trend-cycle series index showing a negative variation of 1.2% compared to July .

Construction data for July 2025, according to INDEC

Indec

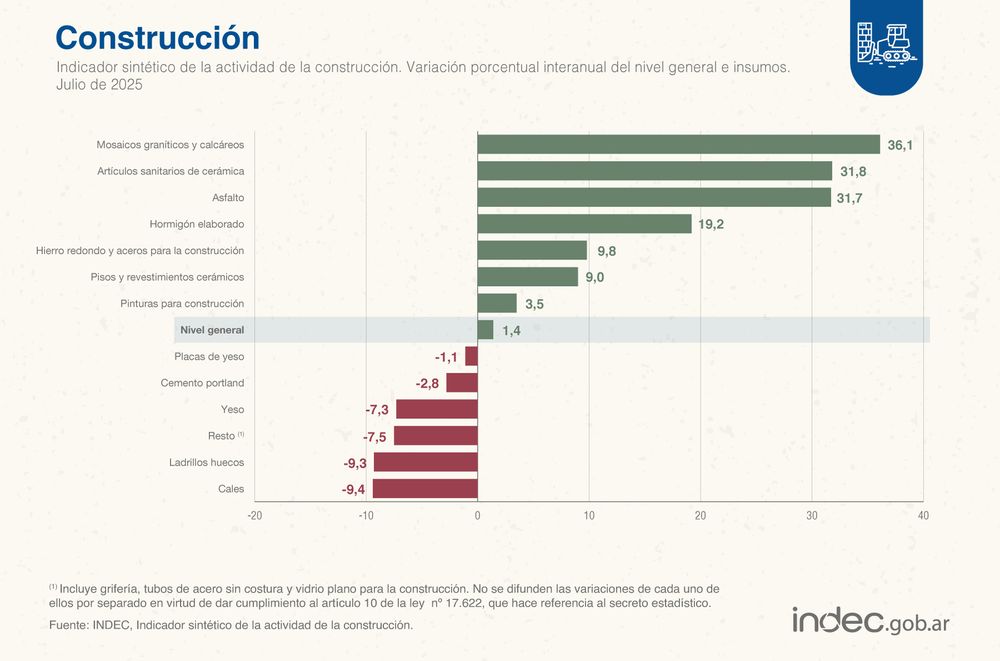

It is worth noting that on a year-on-year basis, construction grew by 1.4% in the seventh month of the year, meaning that the cumulative 2025 original series index shows an increase of 9.2% compared to the same period in 2024 .

Regarding registered jobs in the private sector, the indicator registered a 4.8% increase compared to the same month last year . However, in the cumulative period from January to June 2025, it showed a 0.9% decrease compared to the same period last year.

Construction / Works

The study also evaluated the apparent consumption of construction inputs, revealing mixed results during July. The year-over-year comparison showed the following increases:

- 36.1% in granite and limestone mosaics.

- 31.8% on ceramic sanitary ware.

- 31.7% on asphalt.

- 19.2% in ready-mixed concrete.

- 9.8% in round iron and construction steels.

- 9.0% in ceramic floors and coverings.

- 3.5% in construction paints.

In contrast, the following falls appear:

- 9.4% in lime.

- 9.3% in hollow bricks.

- 7.5% on other inputs: faucets, seamless steel pipes, and glass for construction.

- 7.3% in plaster.

- 2.8% in Portland cement.

- 1.1% in plasterboard.

The largest companies in the sector participating in the survey conducted by INDEC mostly expressed unfavorable expectations regarding the level of activity . The poor outlook covers the period from August to October 2025 .

Construction data for July 2025, according to INDEC

Indec

Faced with this scenario, 68.0% of companies that primarily perform private works expect the sector's activity level to remain unchanged over the next three months , while 21.4% expect it to decrease, and 10.6% expect it to increase. Among companies primarily dedicated to public works, 62.6% believe the level of activity will remain unchanged over this period , while 22.2% expect it to decrease, and 15.2% expect it to increase.

Companies that primarily carry out private works and anticipate an increase in sector activity over the next three months point to the following main causes:

- 33.3% growth in economic activity.

- 24.2% price stability

The main causes of negative forecasts are:

- 31.8% drop in economic activity.

- 18.2% high construction costs.

Regarding the type of work that will be carried out in the next three months, companies primarily involved in private construction divided their responses as follows:

- 16.8% industrial assemblies.

- 13.8% industrial buildings.

- 13.6% commercial buildings.

- 12.9% other architectural works.

- 11.8% others.

For their part, companies that are primarily dedicated to public works responded mainly:

- 21.8% road and paving works.

- 14.5% other architectural works.

- 11.0% water and sewage distribution.

- 10.1% educational buildings.

- 9.1% housing.

Regarding the estimated variation for the next three months in the number of employed personnel, both permanent and contracted, among companies that are mainly dedicated to private works :

- 72.9% expect no changes.

- 18.4% estimate a decrease.

- 8.7% an increase.

In the case of entrepreneurs working with public works :

- 70.4% believe there will be no changes.

- 18.4% estimate that it will decrease.

- 11.2% believe it will increase.

Finally, when it comes to identifying policies that would incentivize the sector, companies that primarily perform private works highlight policies targeting tax burdens (26.2%) and those targeting the labor market (22.1%), among others. Construction entrepreneurs who primarily perform public works lean toward policies targeting tax burdens (22.5%) and those targeting construction loans (22.1%), among others.

losandes