Bitcoin chart analysis: Only one step separates the market from the next major breakout

Bitcoin remains exciting as the week draws to a close. After several failed attempts above the $111,400 mark, the 4-hour chart is showing an increasingly clear picture. The zone between $108,000 and $110,000 remains the heart of the current setup. The price continues to move within a tight range while traders await the decisive impulse that will push the market up or down from the formation.

After the current breakout above the resistance line, it briefly looked as if Bitcoin could sustain the momentum. However, as is often the case, a sustained close above this level was lacking. Long wicks indicated that sellers were still strongly defending here. Only a stable 4-hour candle above 110,400 would provide confirmation of a potential trend reversal.

The overall scenario therefore remains neutral to slightly bullish. Many analysts see the current behavior as preparation for the next surge. A retest of lower levels would be healthy before the market environment shifts back into bull mode. The formation appears stable, and once volume is added, the breakout could quickly gain momentum.

In the short term, some indicators point to a bullish flag currently forming. As long as the 108,500 zone holds, a clean retest could serve as the starting point for a new rally. In this case, targets around 112,700 would be the first hurdle. This is where the neckline of a potential inverse head and shoulders pattern runs, which, in the best case scenario, would allow for a price target of around $125,000.

However, this is still pure theory. Slight signs of fatigue are emerging on the shorter time frames. A pullback to the lower trend lines remains conceivable before the market makes a new start. Only when the price regains momentum on an hourly basis will the direction become clearer. If this attempt fails again, Bitcoin could easily slip below $100,000 before larger buyers become active again.

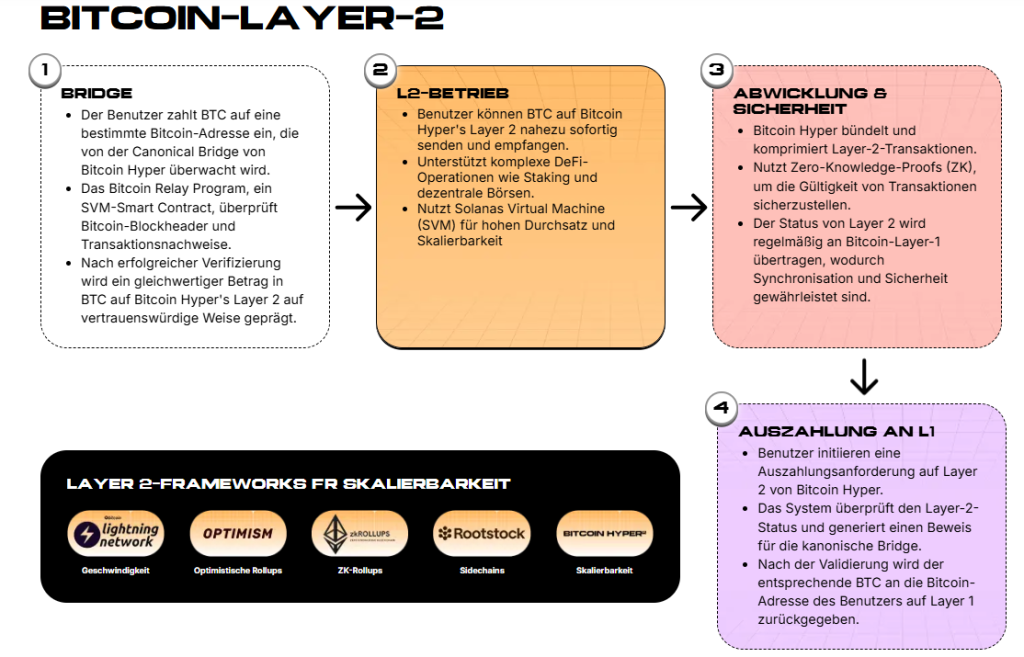

With the renewed outbreak, the altcoin season could also enter its decisive phase. A lot of investment and preparation is already underway; Bitcoin Hyper, for example, already has almost $25 million in its presale pot. The Layer 2 solution combines the speed of Solana technology with the security of the Bitcoin network—an approach that is attracting considerable interest from investors. The project is based on the Solana Virtual Machine, which allows transactions to be executed in parallel.

This combination is also reflected in investor interest. The presale has already raised over $24.6 million, and more than half of the tokens sold so far have been staked directly. The current price is $0.013165, before the next phase starts in a few hours. With a planned ecosystem around applications, staking, and governance, Bitcoin Hyper could become a decisive step for the future of Bitcoin utility, especially during an altcoin season.

Go directly to the Bitcoin Hyper website!

Investing is speculative. Your capital is at risk when investing. This website is not intended for use in jurisdictions where the trading or investments described are prohibited and should only be used by persons and in a manner permitted by law. Your investment may not be eligible for investor protection in your country or state of residence. Therefore, please conduct your own due diligence. This website is provided to you free of charge; however, we may receive commissions from the companies we feature on this website. Furthermore, the author may be personally invested in the assets, which could create a conflict of interest.

nachrichten-aktien-europa